Market Note

Multi-year downtrend in shipping activity

October 31st, 2025

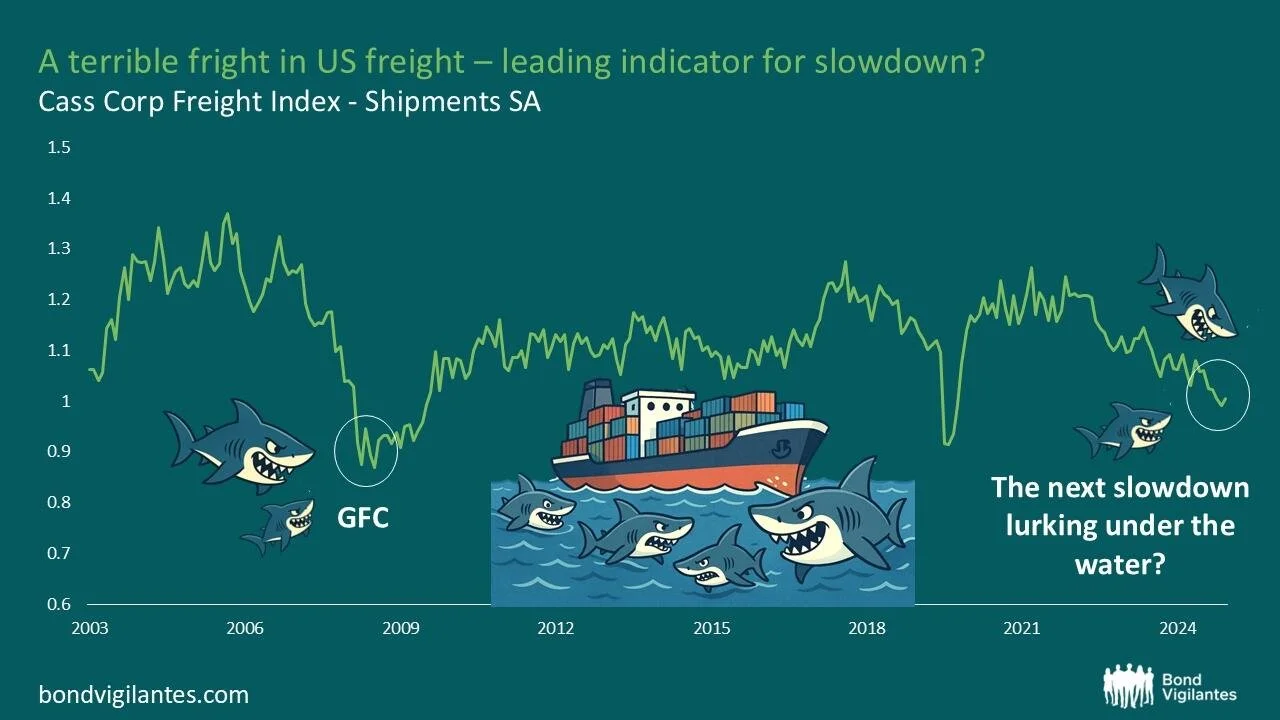

Perma bear journalist Bond Vigilantes.com put together a spooky chartpack. Among the scariest of charts was one showing a slowdown in freight shipments.

The Cass Freight Index is approaching GFC and covid low levels.

Restrictive monetary policy and a weaking consumer has fueled the drop in activity since 2021, and the impact of tariffs have yet to be fully reflected in the data.

Global Markets & Economic Data

- Markets Summary: It's a ghoulish time in the markets as investors digest a busy week of corporate earnings and central bank announcements.

- US: Large cap tech earnings were received with a mixed, but mostly positive tone. The Fed lowered rates by 0.25%, but Powell's communication was considered more hawkish than expected.

- UK/EU/Switzerland: UK house prices rose in October and are up 2.2% y/y; EU Q3 q/q GDP growth is estimated to be 0.1%; inflation figures are running near forecasts in the 2.2% to 2.4% y/y range. The ECB held rates at 2.15%. Swiss ZEW economic sentiment readings picked up in October but remain negative.

- Asia: China Q3 GDP slowed to 4.8% y/y; Tokyo October CPI was 2.5% y/y. The BoJ held interest rates at 0.5% and consumer confidence figures ticked higher.

Index Returns Summary

| Asset Class | MTD | YTD |

|---|---|---|

| MSCI World | +1.56% | +19.40% |

| MSCI Asia Pacific | +0.88% | +21.88% |

| MSCI Europe | +2.10% | +30.31% |

| MSCI China | -2.33% | +39.51% |

| Bloomberg Barclays Global Aggregate Index | +0.20% | +8.11% |

| Bloomberg Commodities Index | +2.63% | +8.57% |

| HFRX Global | +0.75% | +6.40% |

| HFRX Macro/CTA | +1.59% | +4.21% |

| HFRX Equity Hedge | +0.74% | +9.01% |

Index data as of October 24, 2025

Market Spotlight: HyperSCALING: What is Priced In?

Source: Goldman Sachs

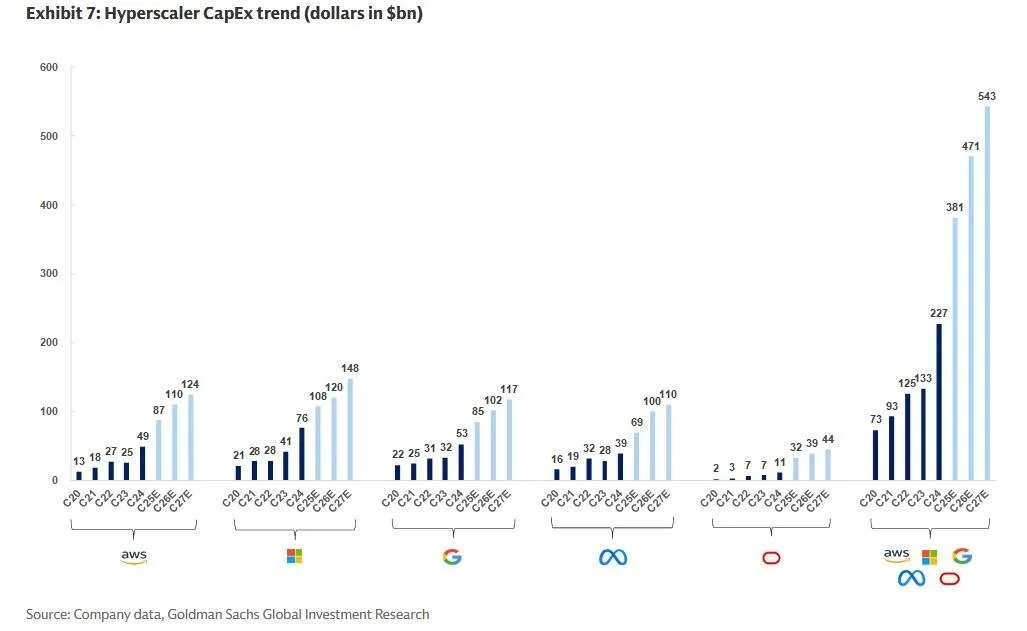

Massive data center AI capex projects are starting to show up in economic data. It is truly impressive to witness such a fast-paced dynamic change in the real economy based on a new technology breakthrough.

Market Spotlight: USDJPY breaking higher

Sell side traders are observing some serious macro hedge fund flow this week into USD/JPY call options. "This trade has been well subscribed by our macro franchise mostly via digitals given realized volatility is holding up well," he said. "We've also seen RKO structures to cheapen the premium expecting potential central bank intervention closer to the key level of 160." (quote from a Nomura trader in Bloomberg article).

Market Spotlight: Indifferent Dec. S&P 500 Calls Flows Activity

The mainstream financial media remains in full-on hype mode to ensure all available capital participates in the next leg higher in the US equity market rally. Baseball metaphors abound as discussions come down to whether we are in the 3rd, 4th, 5th inning etc.

Have Questions or Want to Learn More?

Our team is ready to provide further insights into our strategies and the current market landscape. Reach out to us today.

Contact UsDisclaimer: This material has been prepared by MASTERPIECE ADVISORS for informational purposes only and should not be construed as financial advice. Investments in hedge funds are speculative and involve a high of risk. This material is confidential and may not be disclosed without the express written approval of MASTERPIECE ADVISORS.