Market Note

January FOMC minutes released earlier this week signaled mixed viewpoints within the Fed as some members advocate for further rate cuts while others seek to stay on hold or even raise rates if inflation data heats up.

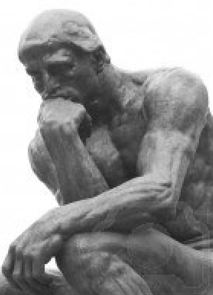

The mixed viewpoints within the Fed are emblematic of the current market environment where investors can interpret developments from positive or negative perspectives.

Market Note

We are observing risk-taking gridlock across markets driven by technical and fundamental rotations that are triggering de-grossing, which amplifies the daily price movements.

AFS Best Practices

The benefits of integrating analysis from hedge fund annual audited financial statements into hedge fund due diligence.

Market Note

As of Friday morning in the pre-market, the S&P 500 is 2% off of its "all-time-highs" reached February 2nd, but it feels a lot worse out there.

Crypto's utility function and market structure are called into question as the price plummets. Crypto treasury companies are entering dangerous territory pressuring their balance sheets, which could pressure prices even lower.

Market Note

Corporate earnings, US presidential decrees, central banks and speculative flows are causing market prices to trend, extend and reverse into month-end.

Market Note

The Russell 2000 has outperformed the S&P 500 and Nasdaq practically every trading day of 2026. The outperformance is fueled by rampant US retail flows and fundamentally driven cyclical rotations as the market "broadens".

Many hedge funds are opportunistic and can sidestep this violent turn of events at a factor/sector/market cap/style level. However, last year's winners are no longer at the top of the charts and that is taking a toll on quant strategies in particular.

Market Note

Sometimes equities climb a wall of worry and sometimes they just vault over all concerns due ample liquidity and a robust economic setup. With global headline inflation relatively subdued and ex-US equity valuations having substantial room for catch-up, its risk-on.

Market Note

The start of the year has featured a marked increase in initiatives by the US government on various economic and geopolitical fronts. This chart is included as a very unserious example of how headline driven price action is dominating the market landscape in the first days of the new year.

With "stimmy checks" on the way, the speculative fervor is rampant for those seeking to generate short-term gains from pushing various topical thematic exposures higher. Various areas like speculative aerospace, rare earths, obscure small cap housing/financials companies and small cap commodities are getting bid to the moon.

Market Note

After accounting for factors that typically explain equity returns, a growing share of U.S. stock returns are tied to a single, common driver. Take one guess of what this driver is? BlackRock and other market participants are urging clients to remain invested in the AI theme. BlackRock in a recent market note told clients that to invest in non-AI opportunities in the US and abroad is a highly influential "active-call" on their portfolios. Instead, they believe owning AI "deliberately" is the winning path ahead.

Market Note

Yields are rising globally as hiking cycles might get underway around the world. Price action post FOMC has featured small cap outperformance and continued softness in long-dated US government bond yields (TLT ETF).