Market Note

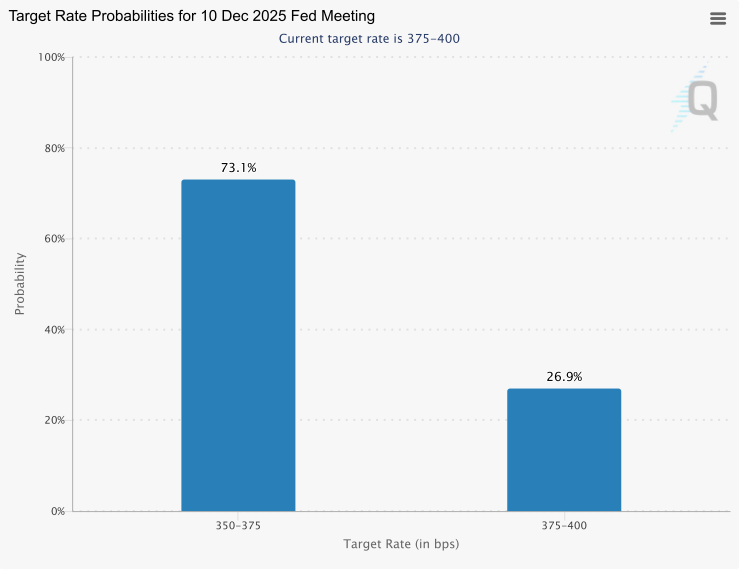

Handicapping Dec Rate Cut Odds

November 21st, 2025

Chart Source(s): CME Fedwatch

The lack of visibility on Fed policy, exacerbated by a lack of official data in the wake of the government shutdown, is curtailing the opportunity set for Macro US FX/Rates trading. Additionally, risk sentiment generally has lacked much direction, because of the cloudy rate outlook.

The probability of a Federal Reserve rate cut in December 2025 sharply declined over recent weeks, falling from nearly 100% a month ago to approximately 30-40% as of yesterday, but now this morning Fed officials are taking on a more dovish tone, bringing the expectations back to ~75% for a cut.

The drop in expectations stems from mixed jobs data, revived inflation concerns, and the impact of government data blackouts.

Global Markets & Economic Data

- Markets Summary: Various technical, sentiment and fundamental headwinds are causing softness in risk assets. Thursday's US session featured post NVDA earnings rally reversal and the continued plummet in crypto prices.

- US: Delayed September US Non-Farm Payrolls data was well ahead of expectations, reducing the odds of a December Fed rate cut, but the Unemployment Rate hit a 4-year high at 4.4%. The Philly Fed manufacturing index improved but remains in contraction territory while the KC Fed manufacturing index was in expansion territory. October Existing Home Sales rose for a second straight month, but activity remains subdued.

- Switzerland/Europe/UK: Swiss Q3 GDP contracted -0.5% q/q. Eurozone Q3 GDP growth is estimated to be 0.2% q/q. UK Retail Sales and consumer sentiment data trended downwards.

- Japan/China: Japan approved a JPY 21.3T stimulus package, the largest since the pandemic that attempts to relieve inflationary pressures that are running above target at 3%. Japan's trade deficit narrowed, fueled by a surge in US auto exports. Chinese prices charged (for both services and manufacturing) jumped to a 3-year high.

Index Returns Summary

| Asset Class | MTD | YTD |

|---|---|---|

| MSCI World | -1.00% | +19.22% |

| MSCI Asia Pacific | +0.05% | +23.55% |

| MSCI Europe | +1.29% | +30.47% |

| MSCI China | +0.87% | +37.31% |

| Bloomberg Barclays Global Aggregate Index | -0.21% | +7.42% |

| Bloomberg Commodities Index | +1.68% | +10.32% |

| HFRX Global | -0.51% | +5.86% |

| HFRX Macro/CTA | -0.96% | +3.07% |

| HFRX Equity Hedge | -0.46% | +8.55% |

Index data as of November 14th, 2025

Market Spotlight: Is it different this time?

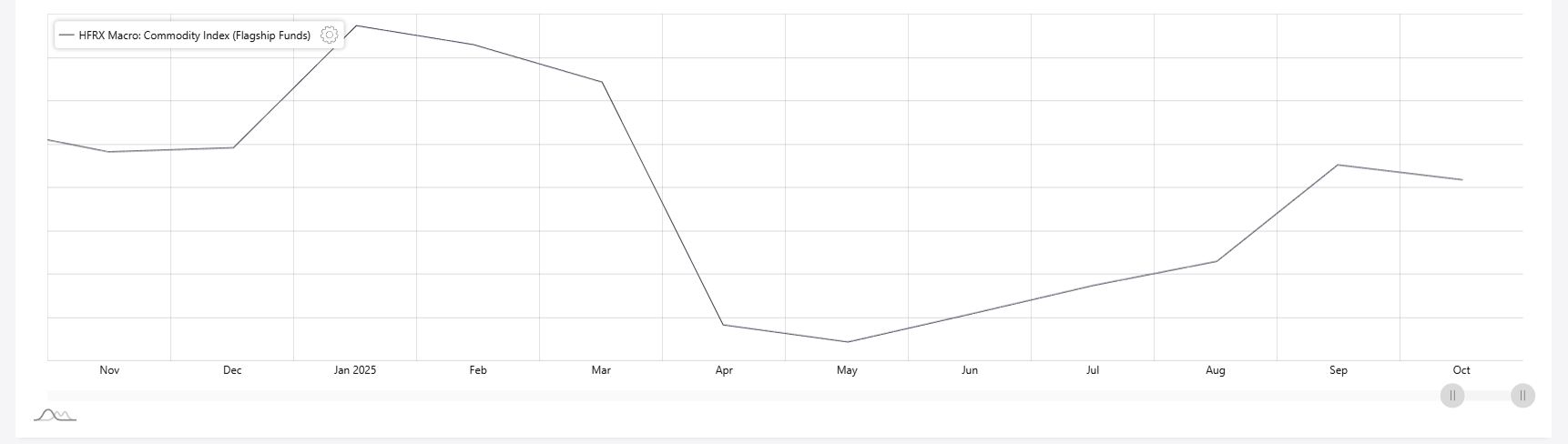

Chart Source(s): HFR

AI adoption trends are impressive with firms of all sizes integrating AI into their day-to-day operations.

Market Spotlight: The macro eats the micro in commodities YTD

Active, fundamentally driven commodity specialist futures traders are having a frustrating year. Headline driven market conditions featuring the "macro eating the micro" are causing headaches.

Market Spotlight: Affordability and Job Loss Concerns

It seems like every day we receive news of yet another major corporation reducing its workforce. Just yesterday, Verizon announced a reduction of 13,000 jobs.

HF Industry Update

The recently released "Billion Dollar Club" H1 2025 report from With Intelligence confirms several key trends and provider rankings in the hedge fund industry.

Chart Source(s): With Intelligence

Have Questions or Want to Learn More?

Our team is ready to provide further insights into our strategies and the current market landscape. Reach out to us today.

Contact UsDisclaimer: This material has been prepared by MASTERPIECE ADVISORS for informational purposes only and should not be construed as financial advice. Investments in hedge funds are speculative and involve a high of risk. This material is confidential and may not be disclosed without the express written approval of MASTERPIECE ADVISORS.