Market Note

Did the music stop in Seoul?

November 14th, 2025

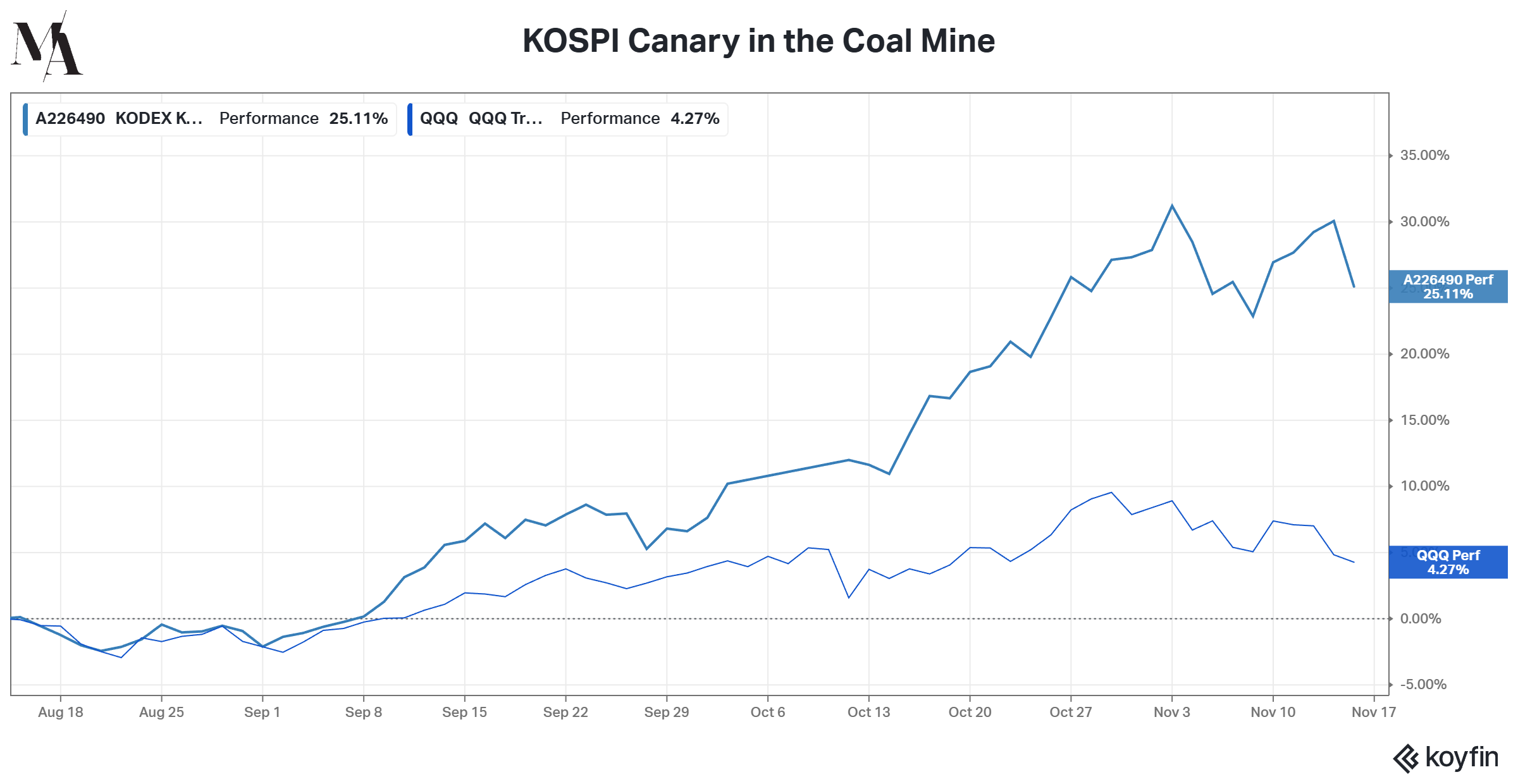

YTD, Korea has been one of the hottest markets globally with notable outperformance of US indices in recent months.

A potent combination of domestic and pan-Asia retail activity with global institutional investor inflows spurred on the rally, with the index up over 60% YTD.

Today Korea's KOSPI equity benchmark index sold off nearly 4% with the selling led by foreigners who sold 2.67T KRW worth of equities, the largest daily net sale this year.

As some of the global AI exuberance gets reigned in, keep a close eye on some of the periphery less liquid markets in the world to start showing signs of cracks first.

Global Markets & Economic Data

- Markets Summary: A dearth of positive catalysts has created a vacuum for the bulls causing some of the more speculative pockets of the market to experience weakness.

- US: The government reopened! US small business optimism is estimated to have fallen in October. Consumer credit growth remains weak.

- Switzerland/UK/Eurozone: Swiss headline unemployment increased to 2.9%, but youth unemployment declined. UK retail sales growth slowed. Eurozone inflation readings continued to show softening conditions.

- China/Japan: Recent Chinese data reflected a continued fragile economy with industrial production, retail sales and household sentiment all coming in weaker than expected. Japanese loan growth hit a 54-month high.

Index Returns Summary

| Asset Class | MTD | YTD |

|---|---|---|

| MSCI World | -1.46% | +18.76% |

| MSCI Asia Pacific | -0.61% | +22.89% |

| MSCI Europe | -0.86% | +28.32% |

| MSCI China | +0.32% | +36.76% |

| Bloomberg Barclays Global Aggregate Index | -0.06% | +7.58% |

| Bloomberg Commodities Index | +0.01% | +8.65% |

| HFRX Global | +0.24% | +6.61% |

| HFRX Macro/CTA | +1.16% | +5.19% |

| HFRX Equity Hedge | +0.27% | +9.28% |

Index data as of November 7th, 2025

Market Spotlight: Industrials, watch out below!

Source: JP Morgan

The rise of Industrial Momentum in 2023 (tracked by JPM in the chart below) coincides with enthusiasm in the AI trade, which has served as a major market catalyst in recent years.

Market Spotlight: Active investing pays in a down market

Morningstar recently concluded a study that found more Active US Equity Funds outperformed passive investments during down markets than up markets.

Have Questions or Want to Learn More?

Our team is ready to provide further insights into our strategies and the current market landscape. Reach out to us today.

Contact UsDisclaimer: This material has been prepared by MASTERPIECE ADVISORS for informational purposes only and should not be construed as financial advice. Investments in hedge funds are speculative and involve a high of risk. This material is confidential and may not be disclosed without the express written approval of MASTERPIECE ADVISORS.