Market Note

Relentless Bid for Hopes and Dreams

Source: Koyfin

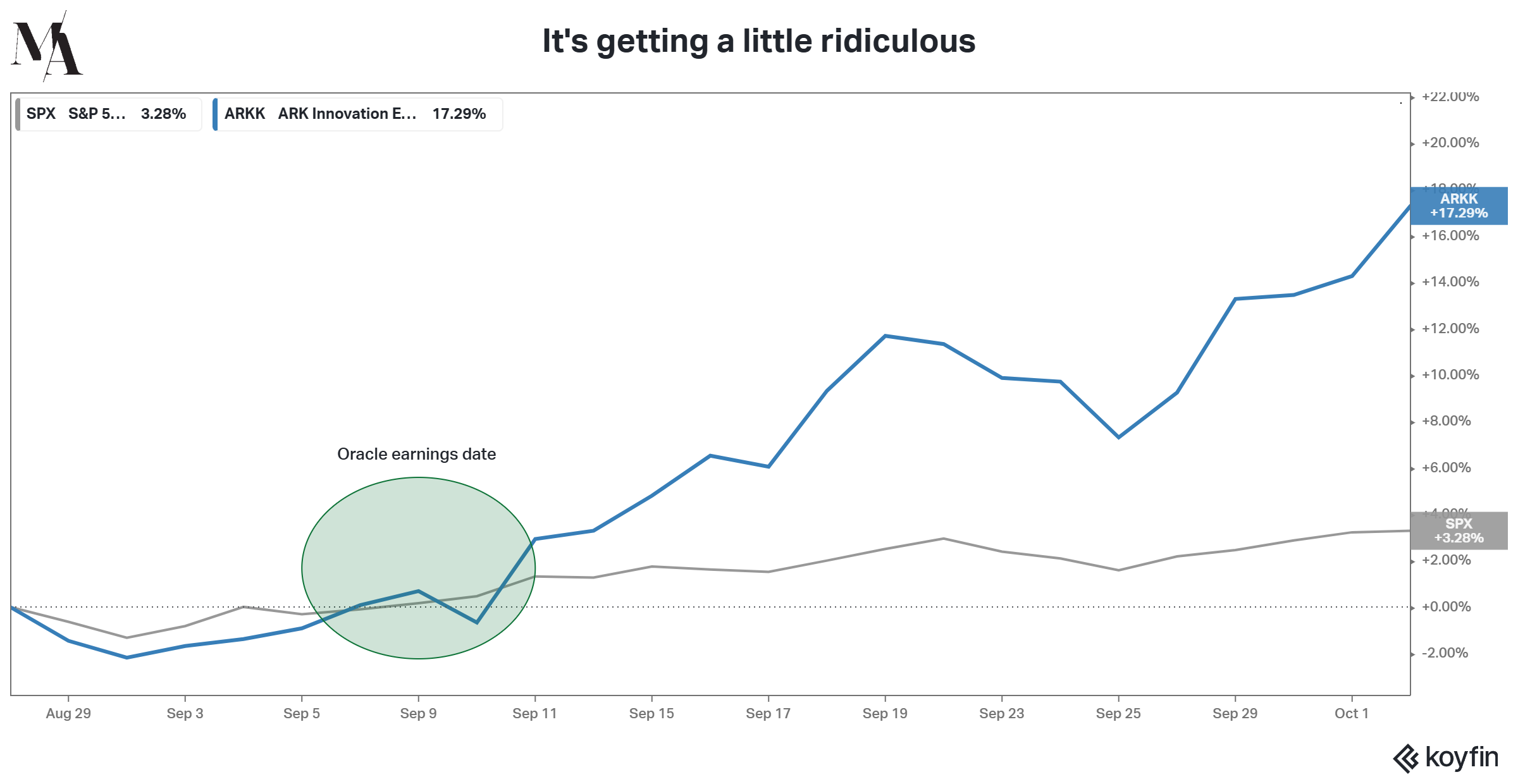

During the early fall period when seasonality is supposed to correct many of the summer technical imbalances, we are instead seeing vol-crushing speculation run rampant. Oracle's shocking AI announcement in early September has unleashed a torrent of speculative fever in the more speculative corners of the US equity markets. The lack of a meaningful pullback for months has emboldened investors, and not even the closure of the US government can stand in the way of the bulls.

Global Markets & Economic Data

- Markets Summary: Risk enthusiasm remains ebullient despite various setbacks such as the US government indefinitely shutting down.

- US: Pre-govt. shutdown, regional Chicago Manufacturing PMI data was deep in contraction territory, but country-wide manufacturing PMI remains at expansion levels. ADP Sep Jobs numbers surprised to the downside at -32k, now falling 3 out of the last 4 months – the worst streak since 2020.

- Europe: UK Q2 GDP final is 0.3% q/q growth, slightly better than forecast but slower than Q1's 0.7% rate. Aug. PMI data rose to 53 suggesting rising growth. Eurozone Sep inflation rose to 2.2% from 2% in August.

- Asia: The Q3 BoJ Tankan Survey showed improved sentiment but also ongoing concerns on a shortage of labor and inflation. China's Sep NBI Manufacturing PMI data rose to 49.6, which was a slight improvement.

Index Returns Summary

| Asset Class | MTD | YTD |

|---|---|---|

| MSCI World | +3.25% | +17.38% |

| MSCI Asia Pacific | +1.75% | +20.67% |

| MSCI Europe | +2.00% | +27.70% |

| MSCI China | +9.77% | +38.99% |

| Bloomberg Barclays Global Aggregate Index | +0.65% | +7.87% |

| Bloomberg Commodities Index | +1.79% | +5.87% |

| HFRX Global | +1.46% | +5.59% |

| HFRX Macro/CTA | +3.53% | +2.65% |

| HFRX Equity Hedge | +1.46% | +8.17% |

Index data as of Sep. 30, 2025

Market Spotlight: Fixing the Glitch in the AI Bubble

Source: CNBC

Oracle's big news in September calmed AI Bubble fears, but upon further review, there is growing concern among technology industry veterans that a circular vendor financing scheme is taking place at a massive scale. Schemes such as these prevailed during the dot-com boom in the late 1990s with telecom suppliers.

Market Spotlight: The Dragon Awakens

Source: Goldman Sachs

The average Chinese Equity Long/Short fundamental fund is up over 20% YTD amid an over 40% return for the MSCI China index. It appears the "Deep Seek" moment in late January was a buying signal for global investors to overcome their fears and participate in the pent-up upside. As the Chinese government and tech leaders have finally synced, it could spur greater advancements and higher share prices.

Market Spotlight: European Equity Flows

Source: Goldman Sachs

Enthusiasm for opportunities in Europe has become more nuanced than at the start of the year. Hedge fund managers have become less bullish, evidenced by the guarded net exposure of European Equity Long/Short funds. There is now greater sector and individual stock differentiation on the long side while macro product hedging flows are trending higher.

Have Questions or Want to Learn More?

Our team is ready to provide further insights into our strategies and the current market landscape. Reach out to us today.

Contact UsDisclaimer: This material has been prepared by MASTERPIECE ADVISORS for informational purposes only and should not be construed as financial advice. Investments in hedge funds are speculative and involve a high of risk. This material is confidential and may not be disclosed without the express written approval of MASTERPIECE ADVISORS.