Market Note

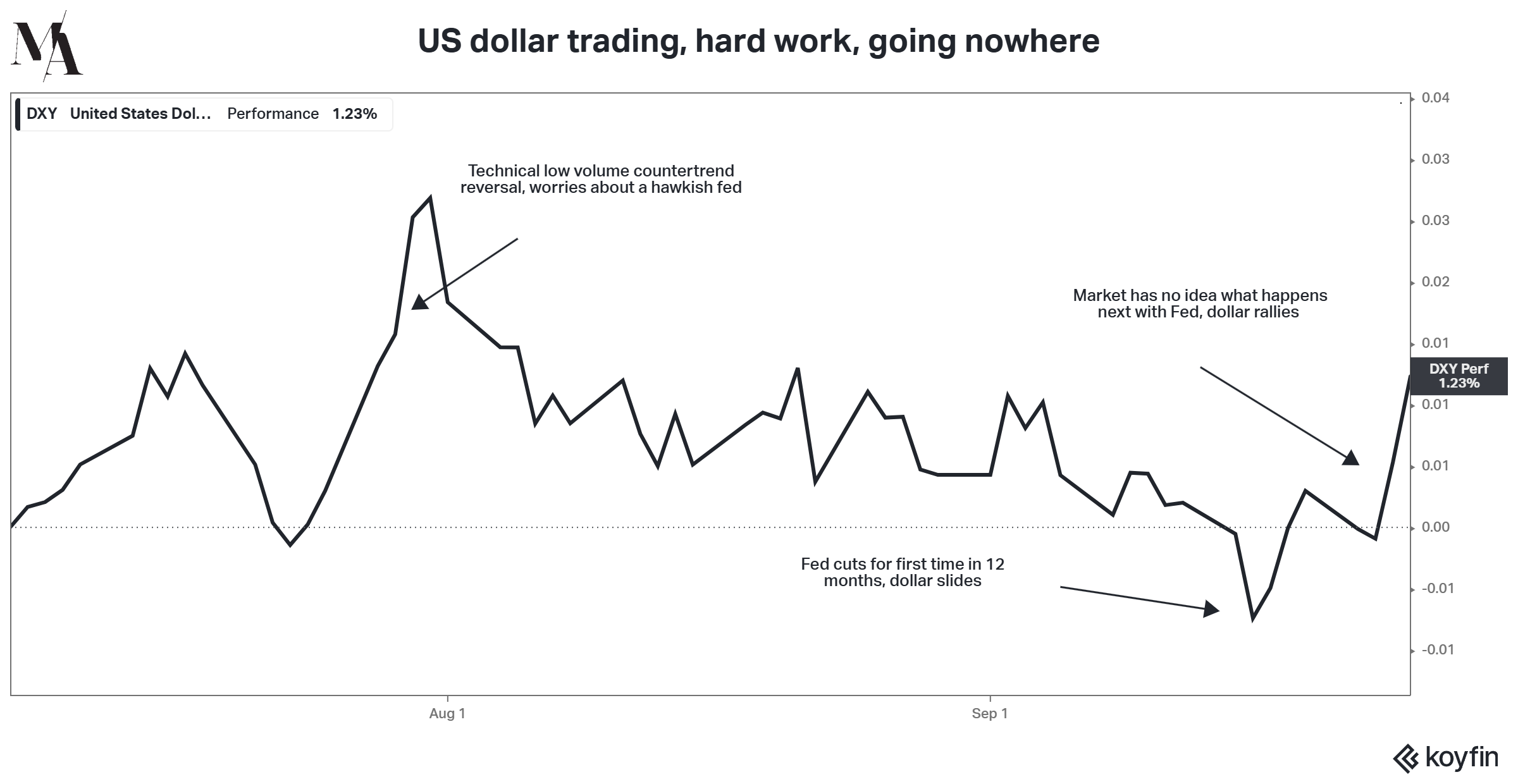

Choppy USD FX Trading

Trading the US dollar has been highly unproductive over the last three months. While the market consensus is for a downward course, the lack of visibility on Fed policy continues to keep the dollar range-bound. This has forced macro FX traders to adopt a tactical discipline to harvest short-term gains rather than pressing for a big breakout move downwards, as markets try to handicap how far US rates can fall.

Global Markets & Economic Data

- Markets Summary: "Goldilocks fatigue" appears to be hitting markets, as bullish speculators require a new batch of positive catalysts to push risk assets higher. Additionally, the collapse of US sub-prime auto lender Tricolor is causing some concern in private credit markets.

- US: September Services and Manufacturing flash PMIs were both in expansionary territory. August New Home Sales hit 800k, Q2 GDP was revised up to 3.8%, and August PCE came in at 2.7% year-over-year, in line with forecasts.

- Europe: The UK's Services PMI for August was expansionary, while Manufacturing continued to contract. The Swiss National Bank held rates at 0%, and the Eurozone's August PMI composite was in slight expansionary territory.

- Asia: Tokyo's CPI fell to 2.5% year-over-year, down from 2.8% previously. Japan's 40-year government bond auction was completed at a 3.3% yield.

Index Returns Summary

| Asset Class | MTD | YTD |

|---|---|---|

| MSCI World | +2.87% | +17.00% |

| MSCI Asia Pacific | +1.08% | +20.00% |

| MSCI Europe | +1.31% | +27.01% |

| MSCI China | +7.43% | +36.65% |

| Bloomberg Barclays Global Aggregate Index | +0.70% | +7.91% |

| Bloomberg Commodities Index | +0.18% | +4.25% |

| HFRX Global | +1.28% | +5.41% |

| HFRX Macro/CTA | +3.22% | +2.34% |

| HFRX Equity Hedge | +1.31% | +8.02% |

Index data as of Sep. 19, 2025

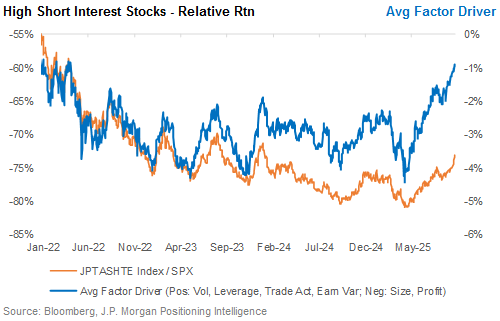

Market Spotlight: Retail Bulls & High Short Interest

A wide disconnect is growing between economic realities and the stock market, which is increasingly viewed as a venue for speculative activity in a world awash in liquidity. The Fed's rate cuts have spurred another wave of furious buying in stocks with the worst fundamentals, creating a challenging environment where sentiment overcomes fundamentals. This presents potential opportunities for those positioned for a return to fundamental normalization.

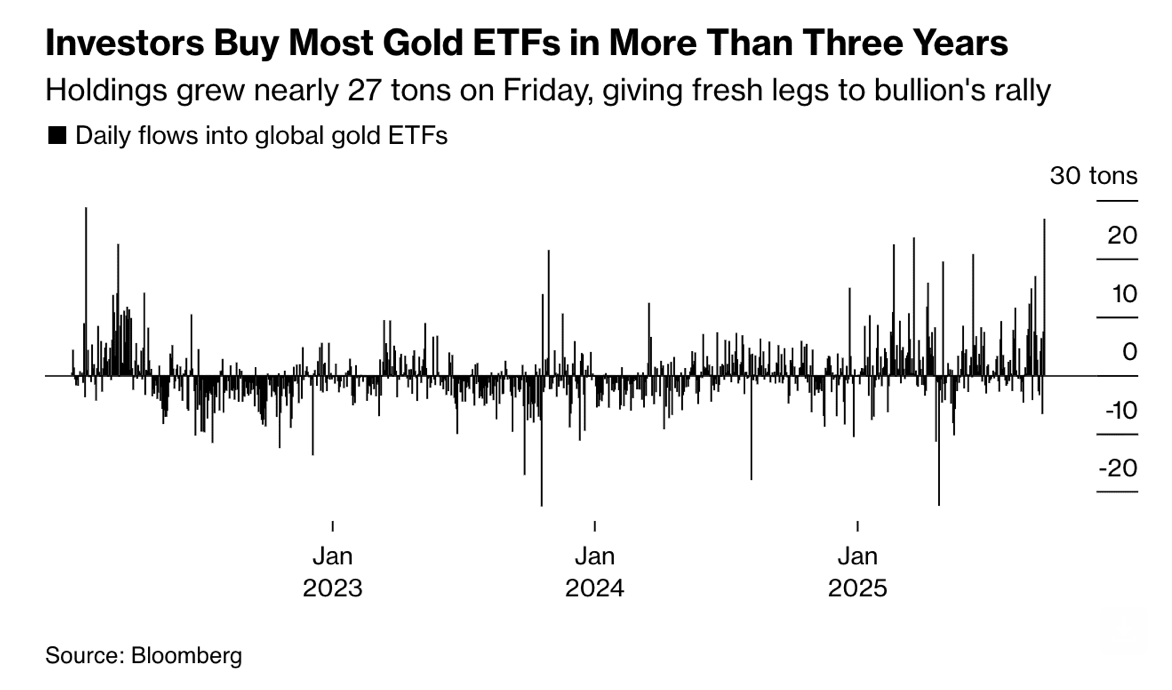

Market Spotlight: The Multi-Faceted Case for Gold

The case for gold is strengthening due to several factors, including political uncertainty, lower US interest rates, and general economic concerns. Some asset allocators are even advocating for a 60/20/20 portfolio of Equities, Fixed Income, and Gold. As global debt loads grow, gold appears to be the best alternative to fixed income, potentially signaling a move towards revaluing physical hard assets over financial ones.

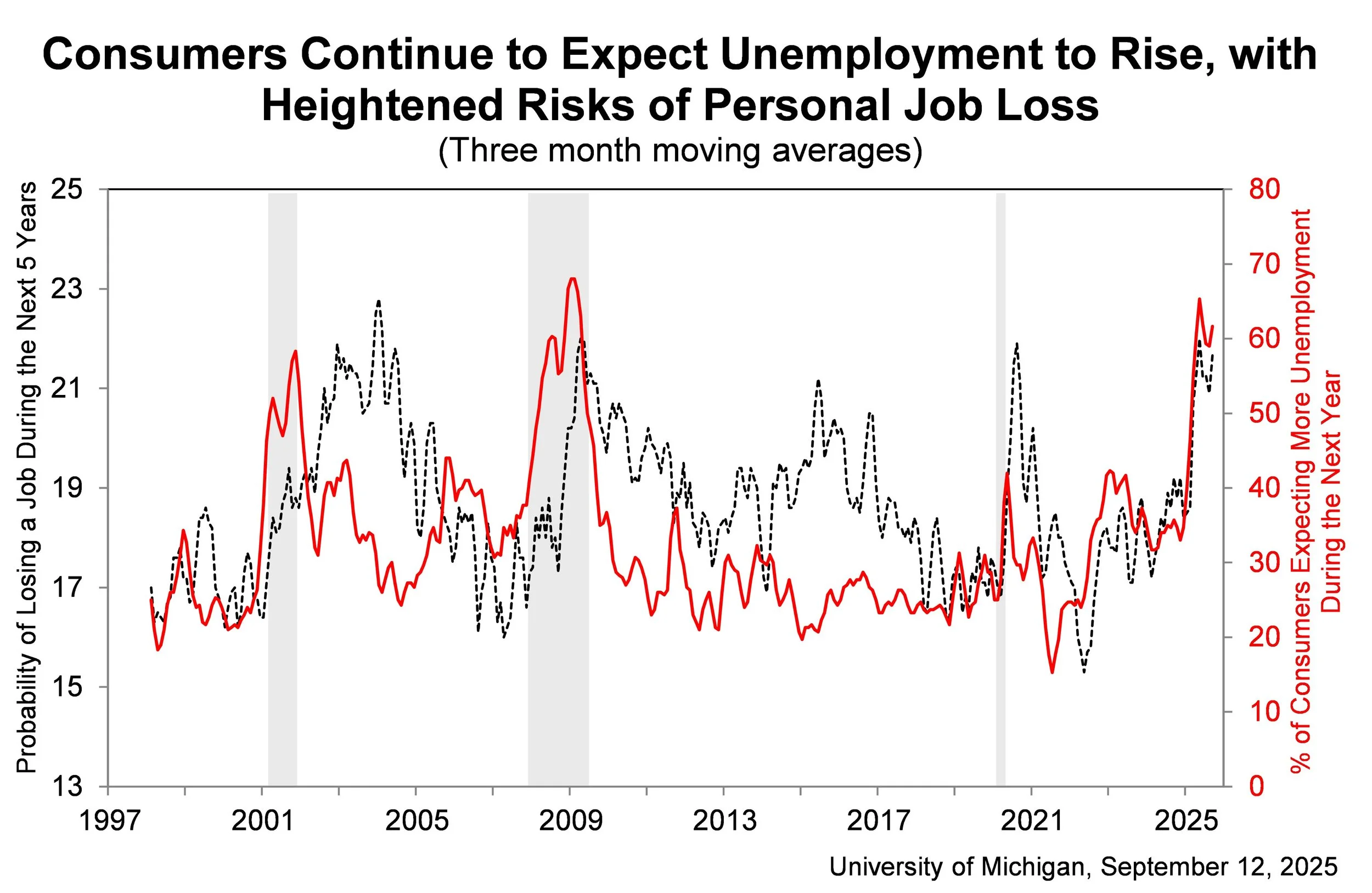

Market Spotlight: Consumer Unemployment Expectations

While software is cheap for consumers, they are already paying the price for AI through higher utility bills. As AI is rolled out across corporations, it presents headwinds of job replacement, particularly at the entry level. This, combined with corporate capex needs forcing job cuts to maintain margins, is contributing to rising consumer fears about future job security.

Have Questions or Want to Learn More?

Our team is ready to provide further insights into our strategies and the current market landscape. Reach out to us today.

Contact UsDisclaimer: This material has been prepared by MASTERPIECE ADVISORS for informational purposes only and should not be construed as financial advice. Investments in hedge funds are speculative and involve a high of risk. This material is confidential and may not be disclosed without the express written approval of MASTERPIECE ADVISORS.