Weekly Note

US Consumer Credit Plummets, Raising Questions About Spending Power

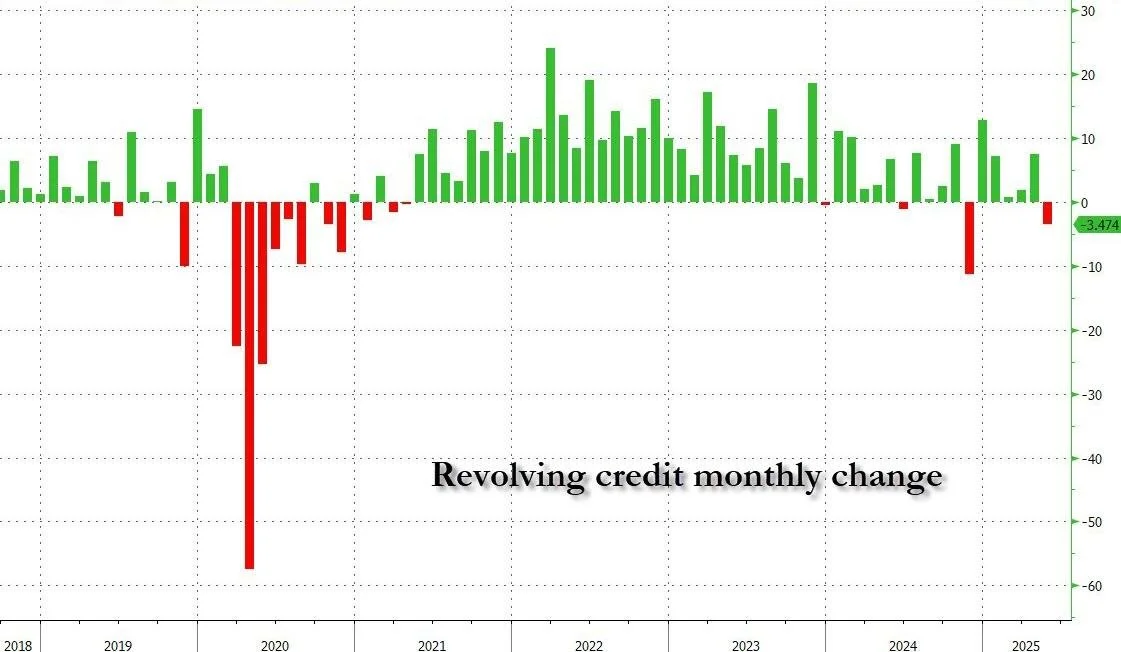

Economy watchers are seeking to determine the cause of a rapid fall in US revolving credit (i.e. credit cards). Is the US consumer finally tapped out after years of spending past its means? Is higher interest rates finally making an impact? Are US consumers buying less in the face of higher prices from tariffs? Did all the macro uncertainty YTD make a tangible dent on consumer behavior? Or is the drop just a statistical aberration that will rapidly reverse itself into more buying of more stuff?

If the US consumer credit downtrend were to continue, some overvalued areas of the stock market linked to US consumer spending could be vulnerable to a pullback.

Within Macro, discretionary strategies are outperforming systematic strategies.

Hedge fund performance varied widely in the first half of 2025. Discretionary macro and European equity strategies outperformed their systematic and US-focused counterparts. Quant equity delivered strong, consistent gains, while Event-Driven and Credit strategies benefited from rising markets and yield.

Is the equity market starting to inflect?

The brief start to H2, checkered by illiquid summer seasonality forces, has shown some interesting micro-developments. Namely, momentum stocks appear to have lost some “momentum” causing a rise in volatility at the stylistic and factor level within the US equity market. Corporate earnings season, inflation data and of course Trump policy moves will provide market guidance for the summer weeks ahead

Contact us to discuss further about hedge funds and markets.