Market Note

Low market vol and high equity valuations

Light trading volumes combined with US economic and corporate data that meet investor's expectations are moving equity valuations to extreme levels. Meanwhile, the VIX volatility index has collapsed since April. The setup is causing ongoing challenges for Equity Long/Short but provides good entry points to initiate individual equity shorts and enter options hedge overlays.

The popularity of European equities

European banks remain a popular sector for hedge funds due to cheap valuations and solid business fundamentals. The investor thesis on owning European stocks is clearly not predicated on exciting growth prospects, exemplified by Germany’s underwhelming GDP trajectory, despite the DAX being one of the best performing country equity markets YTD.

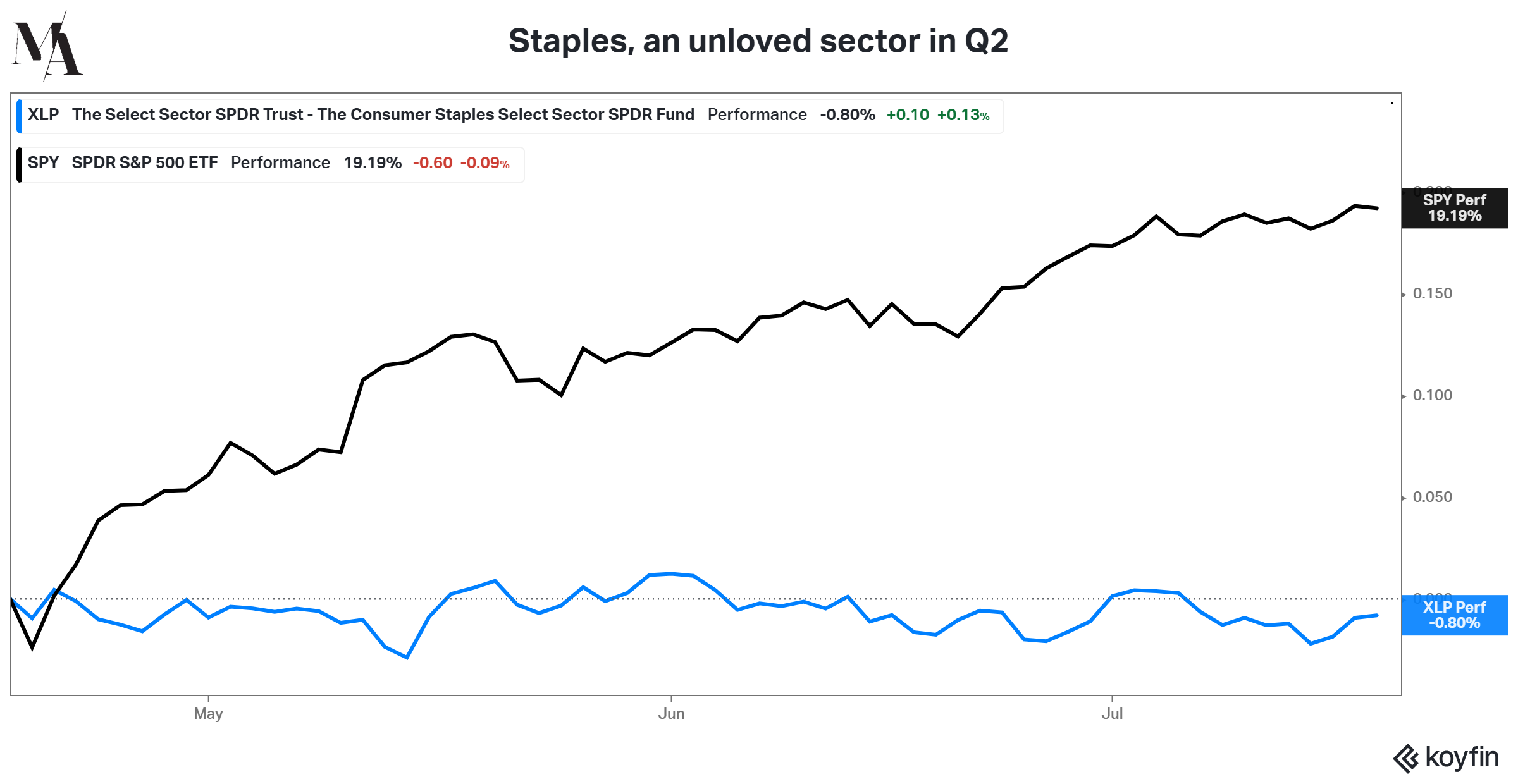

US consumer staples

Prime brokerage monitoring has identified Consumer Staples a beneficiary of hedge fund inflows MTD. Hedge fund flows into consumer staples, a sector widely ignored in recent months, could indicate market paradigm shifts occurring within the US equity market supporting a slowdown of the momentum factor in favor of value.

Contact us to discuss further about hedge funds and markets