Market Note

Taking the escalator up

Global Markets & Economic Data

- Markets Summary: The unwavering enthusiasm for risk assets abounds with US equity indices even finishing flat to slightly higher on Thursday despite little clarity on timing and magnitude of Fed rate cuts given the mixed economic data backdrop.

- US: There were mixed signals from inflation data this week with the CPI coming in slightly below the worst expectations and PPI well-ahead of forecasts, which could be a leading indicator of higher consumer prices in the future. The Fed's annual Jackson Hole summit and Trump's meeting with Putin are in focus.

- EU: UK's Q2 GDP estimates were ahead of expectations. Eurozone's manufacturing PMI continued to be in expansionary territory and unemployment is at record lows. EU gas prices are hitting YTD lows ahead of a potential Ukraine ceasefire.

- Asia: HK Q2 GDP was 3.1%, in line with estimates. Chinese new home prices continue their multi-year downtrend. July Chinese retail sales were down m/m.

Index Returns Summary

| Asset Class | MTD | YTD |

|---|---|---|

| MSCI World | +1.24% | +12.43% |

| MSCI Asia Pacific | +3.39% | +15.64% |

| MSCI Europe | +2.11% | +23.61% |

| MSCI China | +0.88% | +24.02% |

| Bloomberg Barclays Global Aggregate Index | +1.12% | +6.80% |

| Bloomberg Commodities Index | -0.39% | +2.06% |

| HFRX Global | +0.57% | +3.54% |

| HFRX Macro/CTA | +0.25% | -2.56% |

| HFRX Equity Hedge | +0.79% | +5.93% |

Index data as of Aug. 08, 2025

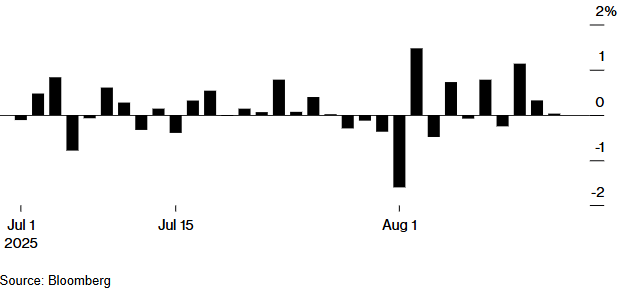

There has been a repetitive pattern in US equity markets over the past weeks; equity index futures trade flat to slightly up or down by a few basis points overnight, have a bit of price swings around the open, then settle with a modest positive day. In fact, there were only 1-2 "big" down days since July 1st. These market conditions have served long-only and long biased strategies well and resulted in extremely low market volatility.

This summer's US equity market trading pattern emphasizes a classic market observation "up on an escalator, down on an elevator". While its been great to see these churning gains higher, all of the summer's gains have the potential to be wiped away in 2-3 days when the next equity market selloff takes hold.

Market Spotlight: July Long/Short Spread

July was a frustrating month for many Equity Long/Short managers. The chart below shows how high conviction consensus hedge fund longs performed versus baskets of shorts across market sub-sectors. Software (AI) is the only sub-sector where consensus longs outperformed a basket of shorts. Meanwhile some of the worst areas were policy driven like Clean Energy and Semiconductors. The chart illustrates the poor performance of a portfolio consisting of consensus long positions compared to basket shorts last month. It highlights the value that can be generated through fundamentally driven security selection on both sides of the portfolio. Masterpiece targets hedge fund managers committed to shorting individual stocks rather than relying solely on ETFs or baskets for short positions.

Market Spotlight: Stocks vs. Bonds

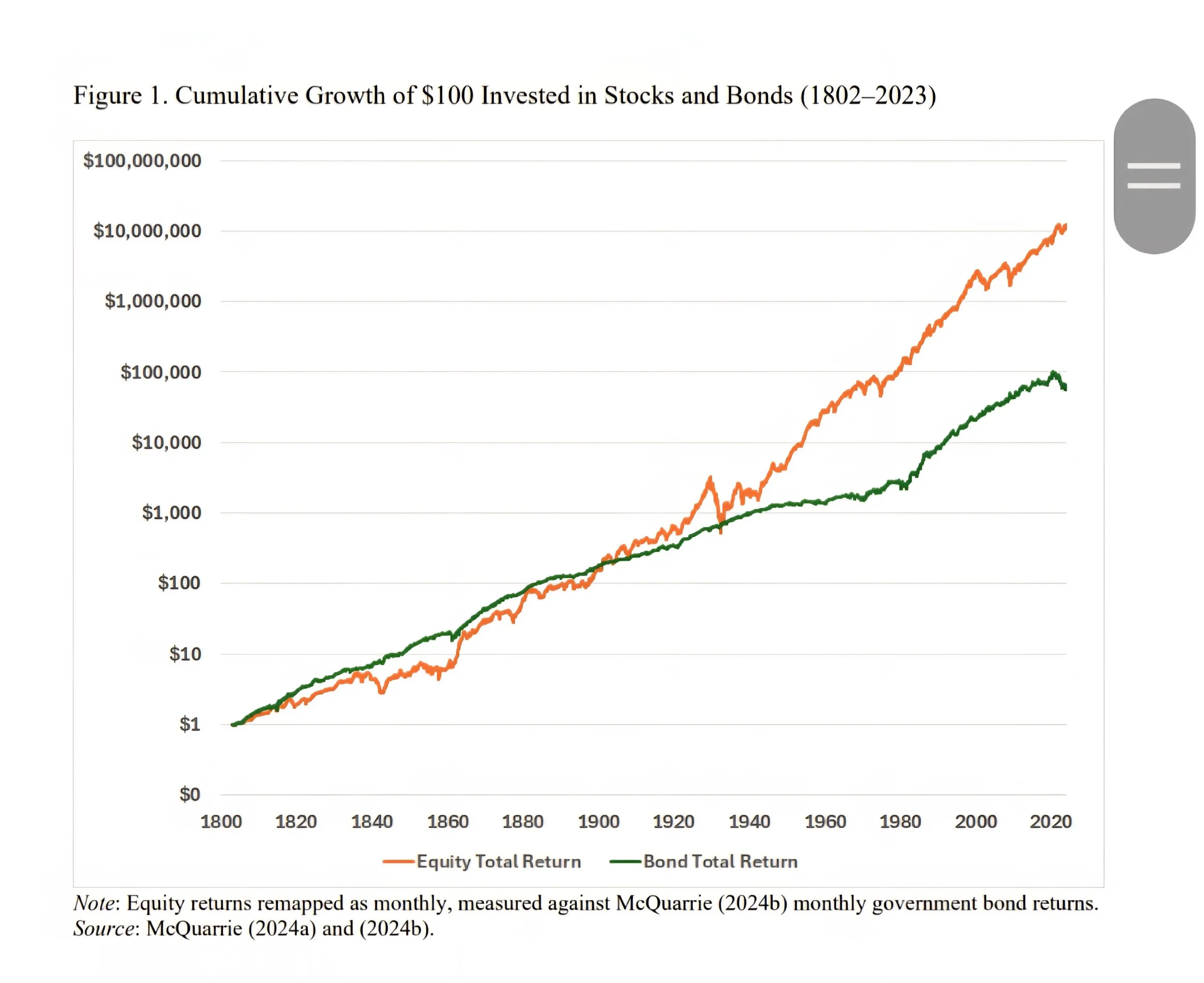

Bank of America strategist Josh Hartnett points out that European equities are making new highs relative to bonds hitting levels reached in April 2000. With European fiscal support, the trend could continue. On a longer term basis the bond versus stocks relationship in markets is interesting to track. There has started to be a rollover in bond performance globally over recent years as government debt globally continues to mushroom. As traditional bond/stock relationships get challenged by various economic and government policy forces, there are widesweeping implications for risk premia and 60/40 bond/stock strategies.

Have Questions or Want to Learn More?

Our team is ready to provide further insights into our strategies and the current market landscape. Reach out to us today.

Contact UsDisclaimer: This material has been prepared by MASTERPIECE ADVISORS for informational purposes only and should not be construed as financial advice. Investments in hedge funds are speculative and involve a high of risk. This material is confidential and may not be disclosed without the express written approval of MASTERPIECE ADVISORS.