Market Note

Can this run for momentum continue?

Global Markets & Economic Data

- Markets Summary: US macro and micro fundamental data is starting to soften which is challenging lofty asset prices.

- US: Q2 GDP jumped to 3%, reversing the Q1 contraction. The July Jobs report was far below consensus estimates and previous monthly reports were revised lower. The Fed held rates unchanged but there are mixed views among members on when to cut rates.

- EU: Eurozone's Q2 GDP was up 1.2% y/y and July inflation was at 2%, matching the ECB's target. June's unemployment rate stayed at 6.3%.

- Asia: Chinese manufacturing and non-manufacturing PMIs fell in June versus May and there is no trade deal finalized with the US. Japanese retail sales rose 1.8% y/y and unemployment held steady at 2.5%. The BOJ left rates unchanged at 0.5%.

Index Returns Summary

| Asset Class | MTD | YTD |

|---|---|---|

| Global Equities | +2.57% | +12.32% |

| Asian Equities | +1.36% | +14.21% |

| European Equities | +1.47% | +25.16% |

| Chinese Equities | +7.37% | +24.82% |

| Global Bonds | -0.77% | +6.51% |

| Commodities | +1.42% | +4.72% |

| Hedge Funds | +0.66% | +3.05% |

| Macro/CTA Hedge Funds | +0.80% | -2.25% |

| Equity Hedge Funds | +0.80% | +5.12% |

Index data as of July 25, 2025

The momentum factor has lifted over the past two years and its relentless trek higher is exemplified in the equity markets with winning stocks continue to trek higher with little consideration for fundamentals.

Such an environment benefits long-biased managers who tend to invest in consensus market winners. However, the environment leads to poor overall market breadth causing problems for contrarian-minded investors because their longs lag the momentum stocks and their shorts get caught up in momentum driven short squeezes.

Eventually periods like 2022 arise when the momentum factor gets swiftly reversed. The bubbly US equity market environment since April has market commentators making comparisons to 2021, 2007/2008, and the late 90s dotcom bubble.

Market Spotlight: H1 Hedge Fund Flows Snapshot

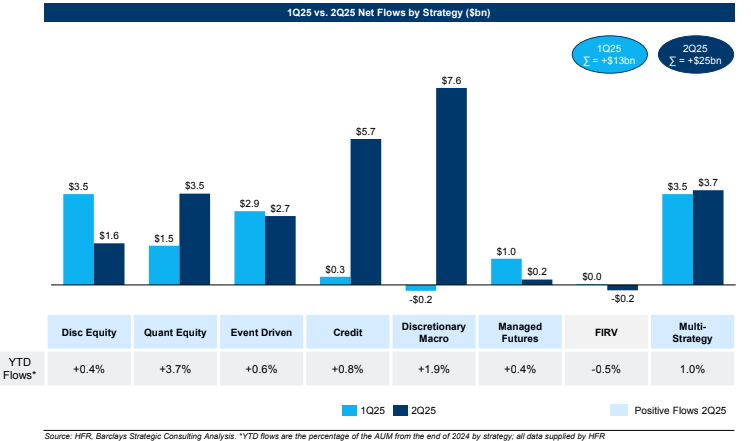

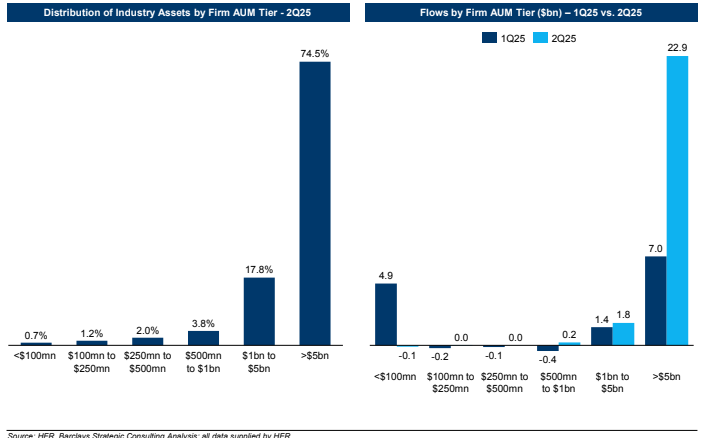

The hedge fund industry experienced widespread inflows in H1 across all strategies. Discretionary Macro was a standout recipient of inflows, which could indicate growing investor demand for diversifying strategies at this stage of the market cycle. The majority of the inflows were into the largest hedge funds. In fact 90% of the H1 flows went to hedge funds with \$5b of capital or higher.

Market Spotlight: Fragile US growth backdrop

It is no illusion that an upswing in government spending is enabling the US economy to continue growing with little interruption in recent years despite a higher rates environment. Economists warn that debt fueled economic growth is not sustainable and usually results in higher borrowing rates and a weaker sovereign credit position.

Have Questions or Want to Learn More?

Our team is ready to provide further insights into our strategies and the current market landscape. Reach out to us today.

Contact UsDisclaimer: This material has been prepared by MASTERPIECE ADVISORS for informational purposes only and should not be construed as financial advice. Investments in hedge funds are speculative and involve a high of risk. This material is confidential and may not be disclosed without the express written approval of MASTERPIECE ADVISORS.