Market Note

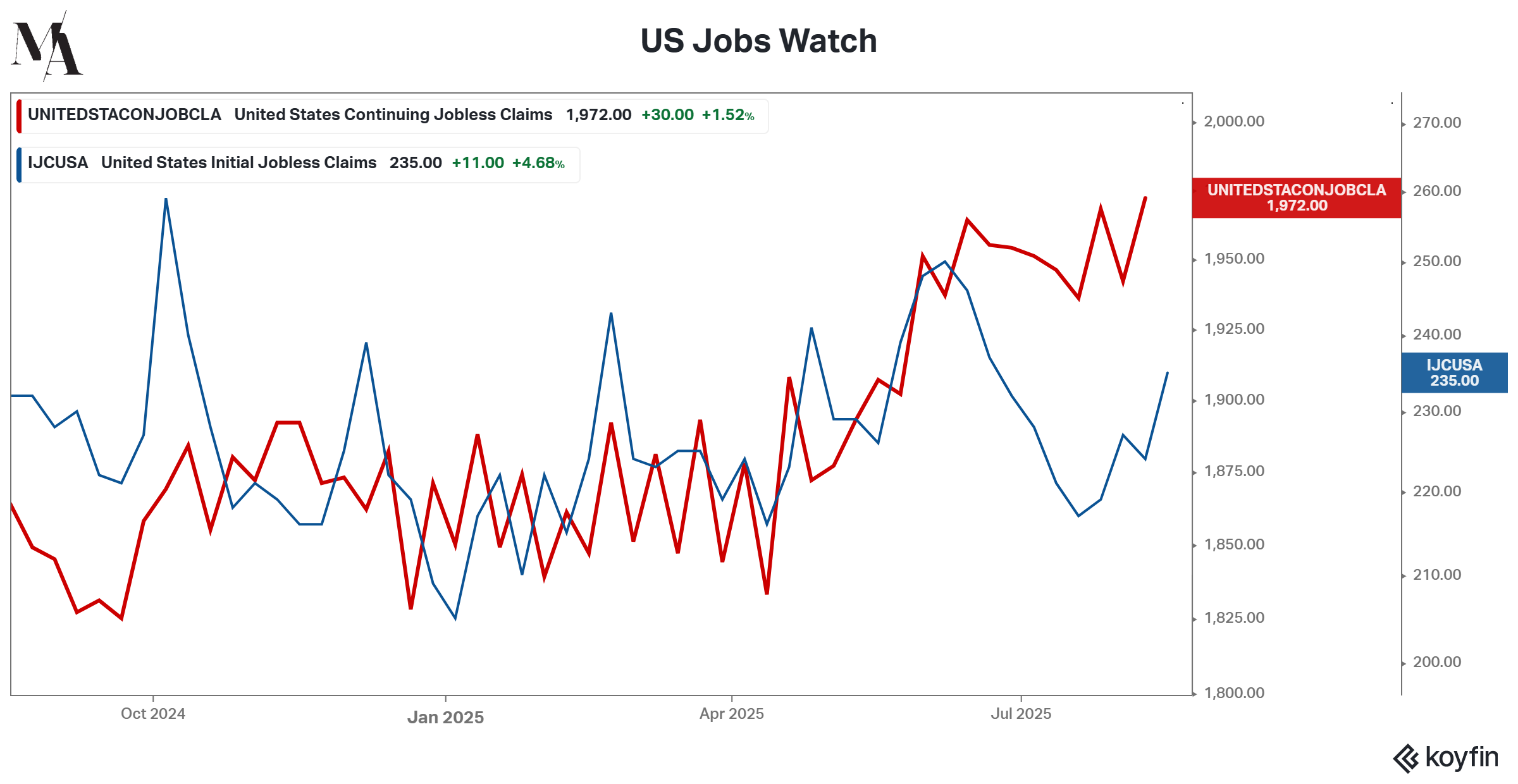

How healthy is the US labor market?

With continuing claims hitting YTD highs and trending higher over the past quarter, the question becomes whether this could be a leading indicator of greater deterioration in US economic data statistics. Initial claims remain relatively rangebound and noisy after the big DOGE initiatives in Q1. Worsening jobs numbers could help support the Fed/Trump's rationale to reduce interest rates in September. FX and rates markets are currently attempting to price in multi-dimensional scenarios of Fed actions in light of ongoing mixed US economic data.

Global Markets & Economic Data

- Markets Summary: August has featured a more subdued risk tone as US stocks were down for five consecutive trading sessions, their longest losing streak YTD. The week was marked by anticipation of Fed policy cues ahead of Jackson Hole.

- US: July housing starts were up 5.2% m/m driven by multi-family starts. Weekly Initial Jobless Claims made their largest jump, and continuing claims are trending higher. PMI data was solid across Manufacturing and Services. FOMC minutes indicate a split Fed over future actions.

- Europe: There was slightly better-than-expected PMIs and modest inflation prints, which signaled only marginal improvement in economic momentum. Eurozone and UK PMIs were led by Services with Manufacturing in contractionary territory.

- Asia: There was strong Japanese services PMI and inflation slightly above expectations in some subcomponents. Japanese Machinery orders were negative m/m. Chinese rates remained unchanged, in line with forecasts.

Index Returns Summary

| Asset Class | MTD | YTD |

|---|---|---|

| MSCI World | +2.50% | +13.69% |

| MSCI Asia Pacific | +6.79% | +19.04% |

| MSCI Europe | +4.06% | +25.56% |

| MSCI China | +3.89% | +27.03% |

| Bloomberg Barclays Global Aggregate Index | +1.13% | +6.81% |

| Bloomberg Commodities Index | -0.79% | +1.66% |

| HFRX Global | +0.76% | +3.73% |

| HFRX Macro/CTA | +1.19% | -1.62% |

| HFRX Equity Hedge | +1.04% | +6.18% |

Index data as of Aug. 15, 2025

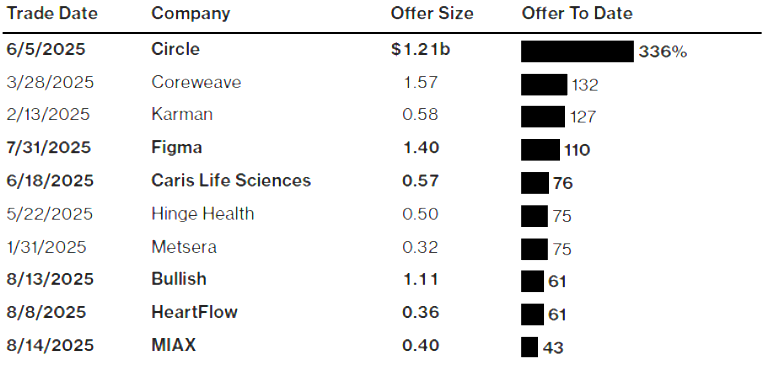

Market Spotlight: The resurgence of IPOs!

We recognize that the cryptocurrency and AI ecosystems stand to gain significantly from enhanced funding channels that can facilitate their expansion and success. Fortunately, recent market conditions have allowed the Initial Public Offering (IPO) pathway to reopen. For several years, IPO activity has lagged behind historical trends, exacerbated by ongoing corporate takeovers that have led to a contraction in the overall number of U.S. public equities. An increase in IPOs introduces more securities for investors to trade, particularly in the post-IPO phase. Notably, several recent IPOs are projected to face bankruptcy within the next 24 months, highlighting potential risks. The current surge in IPO activity during a period of abundant market liquidity is noteworthy and may indicate a market peak, especially considering that many of these IPOs lack quality. In a healthy market cycle, we would expect to see a series of high-quality IPOs, supported by the robust pipeline of pre-IPO private investments.

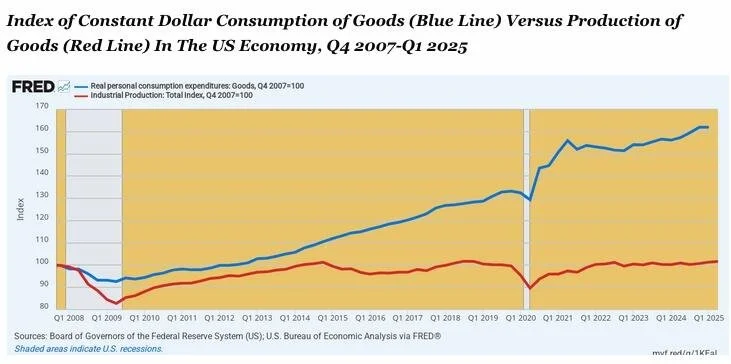

Market Spotlight: Reflections on the US economy

Ever since ZIRP policies were enacted in 2009 to save the financial system there has been a notable drop in US industrial domestic production while consumption trends higher. The appetite of the US consumer has no ends and the economy has been re-ordered over the past decade plus to cater to everyone's needs. The sustainability of such a spread in production versus consumption for the world's largest economy is questionable as many longstanding economic principles continue to be tested by the dual impact of ongoing technological developments and policy maker market interventionist strategies.

Have Questions or Want to Learn More?

Our team is ready to provide further insights into our strategies and the current market landscape. Reach out to us today.

Contact UsDisclaimer: This material has been prepared by MASTERPIECE ADVISORS for informational purposes only and should not be construed as financial advice. Investments in hedge funds are speculative and involve a high of risk. This material is confidential and may not be disclosed without the express written approval of MASTERPIECE ADVISORS.