Market Note

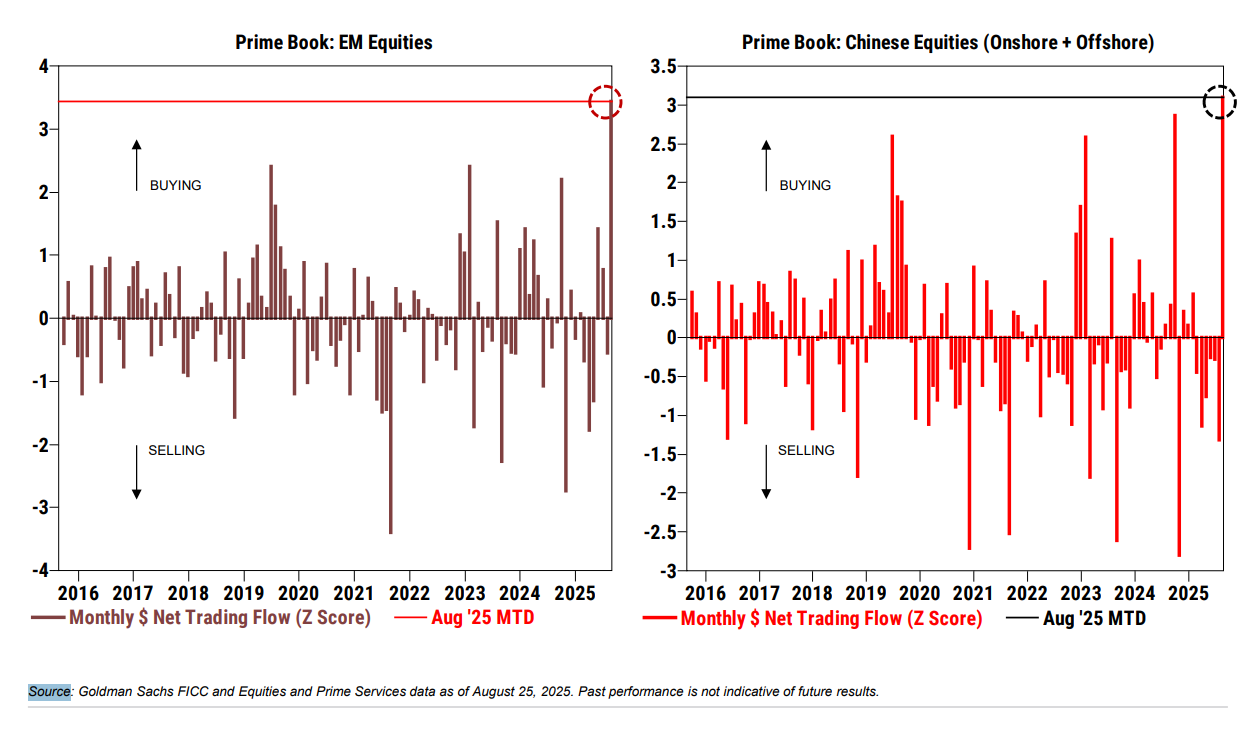

EM and China HF flows turn positive!

A weaker dollar and settlement of US tariff negotiations is supporting an uptick in sentiment and increased capital flows towards emerging markets and China. While domestic Chinese stories remain plagued by the economic overhang, many global Chinese manufacturing and technology firms have low valuations versus global peers.

Global Markets & Economic Data

- Markets Summary: The final weeks of August have featured low volatility amid a mixed, but generally positive, economic backdrop as investors continue to seek visibility on US rate policy.

- US: The steady march of mixed US economic data readings continues. Q2 GDP was better than expected, growing by 3.3%. Weekly jobless claims numbers were within recent ranges. PCE inflation data continued to read slightly hot but not reaching an alarmist level, and consumer spending remains robust.

- EU: Q2 GDP data was up 1.4%, slowing from Q1. Q2 GDP growth was led by Spain, France and Portugal. French August inflation continued to trend lower. German manufacturing activity picked up in August, helping the EU manufacturing PMI move into expansion territory for the first time in 3 years. Sentiment data ticked lower in July for both businesses and consumers.

- Asia: Chinese confidence data ticked lower for a seventh consecutive month. July industrial profits fell 4.3% y/y and 2025 GDP's forecast fell to 4.7%. Japanese unemployment fell and inflation measures continue to remain hot but have leveled off in recent months. Japanese consumer confidence remains suppressed.

Index Returns Summary

| Asset Class | MTD | YTD |

|---|---|---|

| MSCI World | +2.99% | +14.18% |

| MSCI Asia Pacific | +6.44% | +18.69% |

| MSCI Europe | +5.55% | +27.05% |

| MSCI China | +5.52% | +28.66% |

| Bloomberg Barclays Global Aggregate Index | +1.30% | +6.98% |

| Bloomberg Commodities Index | +0.44% | +2.89% |

| HFRX Global | +1.06% | +4.03% |

| HFRX Macro/CTA | +1.76% | -1.05% |

| HFRX Equity Hedge | +1.48% | +6.62% |

Index data as of Aug. 22, 2025

Market Spotlight: Defensive Shifts

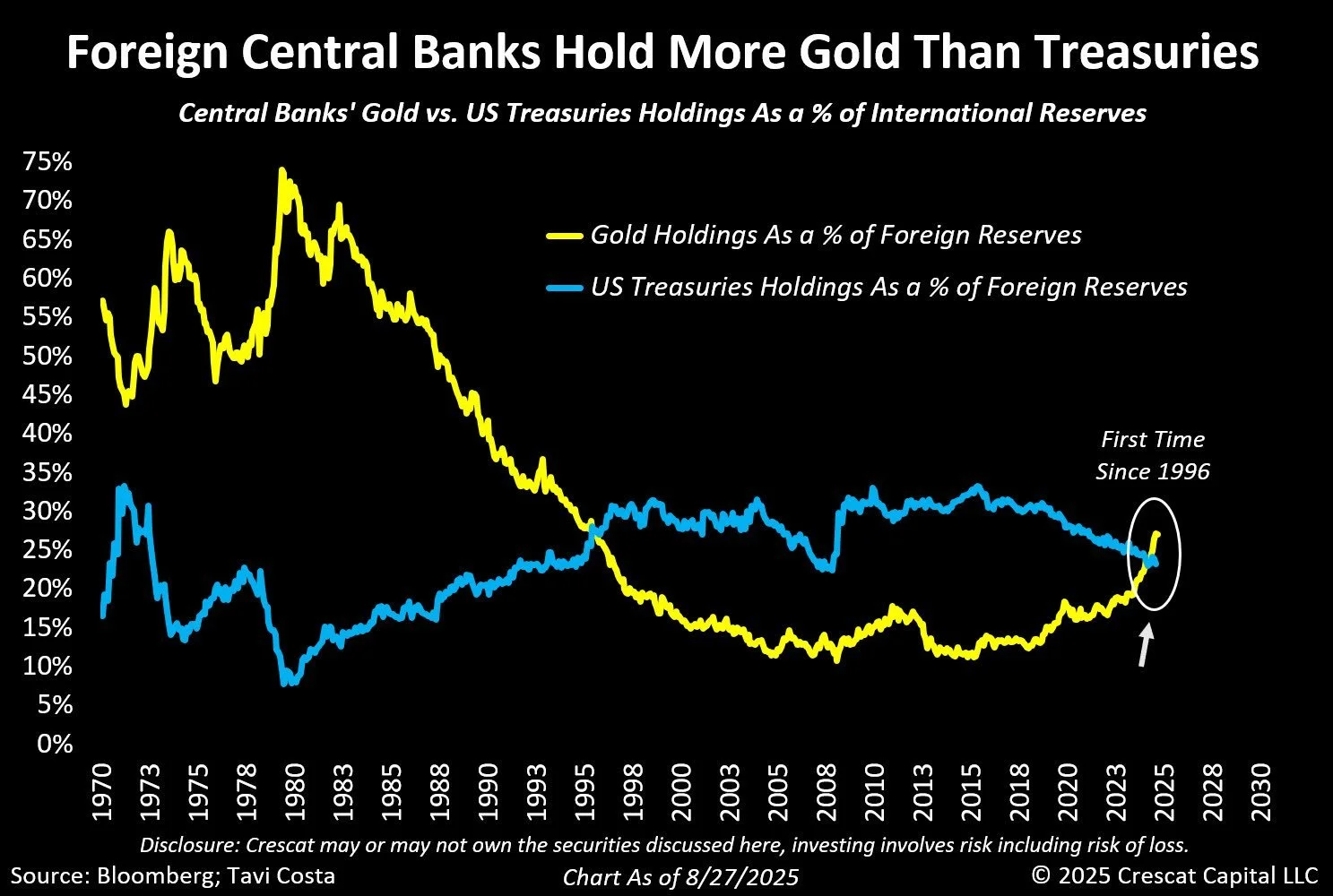

What's a HF newsletter without banging the drum about bearish trends in the marketplace. While the general consensus is that the US economy remains in soft landing territory, there are multiple data points adding to greater defensive shifts of capital. Currently there is an uptick of flows into fixed income, central banks hold more gold than US treasuries and WTI oil positioning has turned net short. Meanwhile, on a longer term basis, the threat of a tapped out US consumer who hits their proverbial debt ceiling seems to be increasingly upon us.

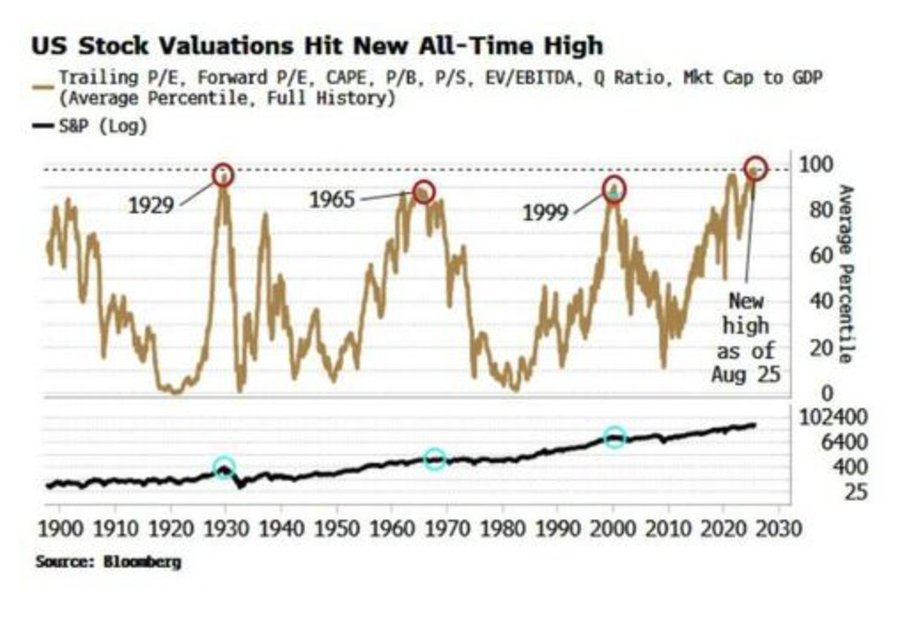

Market Spotlight: Hitting the bid

Hedge funds have recently become better sellers of equities alongside an uptick in selling by retail investors. Meanwhile, institutional investors remain steady buyers. Several risk indicators remain flashing warning signs for investors seeking greater equities exposure at this moment including valuation indicators and the net positioning level of investors in volatility futures (net short), which provides a strong data point to confirm the market complacency observed in the markets in recent months.

Market Spotlight: Mega Cap Tech vs ROW

One needs to look no farther than this Mag 7 EPS chart to observe why market breadth has been terrible in recent years while headline market indices that are dominated by Mag 7 names continue to fly ahead outperforming all active diversified long equity investment strategies. An interesting chart included here is the inflection of TV viewership trends where streaming has now surpassed traditional TV. As these trends further materialize the risks and opportunities across the Media and Entertainment sector setup for many winners and losers for hedge funds to position ahead of.

Have Questions or Want to Learn More?

Our team is ready to provide further insights into our strategies and the current market landscape. Reach out to us today.

Contact UsDisclaimer: This material has been prepared by MASTERPIECE ADVISORS for informational purposes only and should not be construed as financial advice. Investments in hedge funds are speculative and involve a high of risk. This material is confidential and may not be disclosed without the express written approval of MASTERPIECE ADVISORS.