Market Note

It's déjà vu all over again

November 7th, 2025

This year the S&P 500 is on a bit of a hybrid/WFH schedule rallying at the start of the week then closing out Thursday and Friday with more sellers than buyers.

The trend could be in place due to the heightened geopolitical and domestic political uncertainty inspiring investors to de-risk into the weekend.

YTD top-down sentiment driven market price movements are frustrating for fundamentally driven hedge fund strategies.

Global Markets & Economic Data

- Markets Summary: Risk-off is dominating at the end of the week. NVDA is down 11% since Nov. 3rd ahead of next Wednesday's quarterly earnings release.

- US: ADP private payrolls showed a modest rebound in October. State sources for weekly jobless claims showed no uptick and during October there was a rise in tech layoffs. ISM figures remained in contractionary territory.

- UK/EU/Switzerland: UK Q3 GDP was up 0.2% q/q. Germany's ZEW sentiment survey hit a 4-month high.

- Asia: China's Q3 GDP growth surprised to the upside at 4.8% y/y, slowing from the 5.2% rate in Q2.

Index Returns Summary

| Asset Class | MTD | YTD |

|---|---|---|

| MSCI World | +2.02% | +19.86% |

| MSCI Asia Pacific | +2.07% | +23.07% |

| MSCI Europe | +0.76% | +28.97% |

| MSCI China | -3.81% | +38.03% |

| Bloomberg Barclays Global Aggregate Index | -0.25% | +7.65% |

| Bloomberg Commodities Index | +2.55% | +8.49% |

| HFRX Global | +0.68% | +6.33% |

| HFRX Macro/CTA | +1.38% | +4.00% |

| HFRX Equity Hedge | +0.68% | +8.95% |

Index data as of October 31st, 2025

Market Spotlight: AI in a Loop

OpenAI's CFO this week said that the market is too anxious about a possible bubble in AI and separately the firm founder Sam Altman testily responded to a pointed question on its $13b current revenue versus its $1T of spending commitments by saying "if you want to sell your shares, I will find you a buyer".

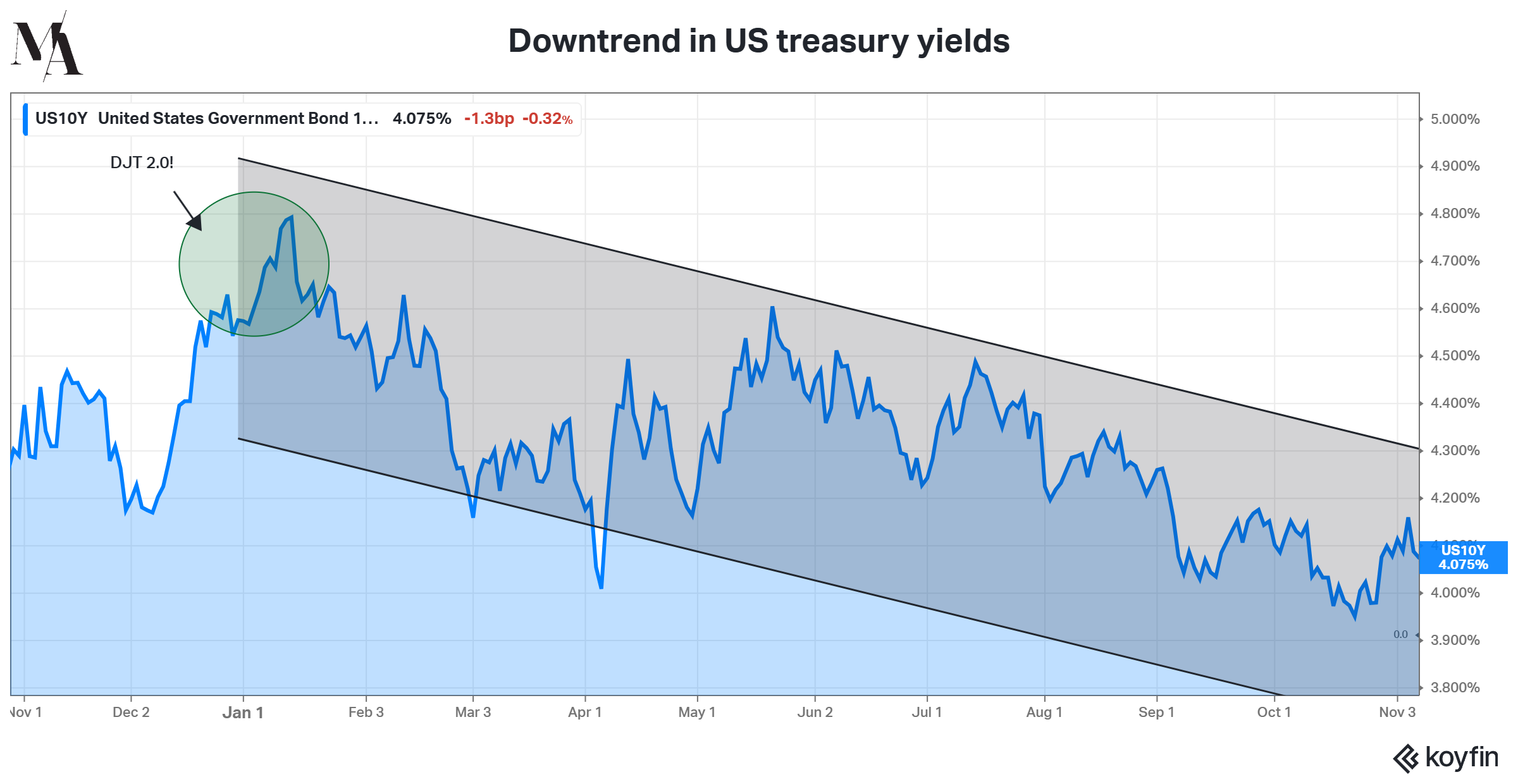

Market Spotlight: US bond yields going lower

Lately equities indices have been falling alongside bond prices, which is atypical.

Have Questions or Want to Learn More?

Our team is ready to provide further insights into our strategies and the current market landscape. Reach out to us today.

Contact UsDisclaimer: This material has been prepared by MASTERPIECE ADVISORS for informational purposes only and should not be construed as financial advice. Investments in hedge funds are speculative and involve a high of risk. This material is confidential and may not be disclosed without the express written approval of MASTERPIECE ADVISORS.