Market Note

A surge of optimisim

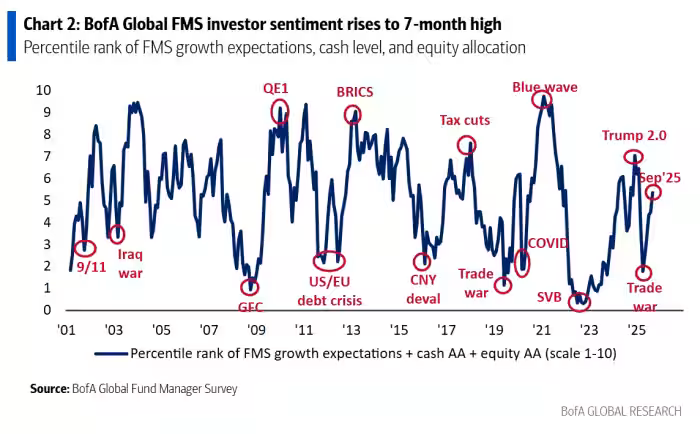

While skeptical and cautious investors can ponder various secular headwinds facing the global economy, fund manager sentiment has roared back since April as managers begin to sync better with the Trump's bluster first, negotiate later approach to policy initiatives. Multiple examples of Trump backing down from aggressive threats to making sensible compromises. The rise in sentiment coincides with all-time-high price levels for global equities alongside the Fed reducing interest rates for the first time in 12-months.

However, as consensus grows that the US economy heading towards an impressive soft-landing cause investors into trades that benefit from this view, any negative development to shake this narrative could strike markets violently as crowded trades unwind.

Global Markets & Economic Data

- Markets Summary: There is seemingly nothing that can stop the Al-juiced equity market now that the fed is starting to cut interest rates. Macro assets are mixed as investors remain left with little medium-term visibility on how far US rates will fall.

- US: The Fed cut rates by 25bps and signaled the potential for two more cuts by YE. August ISM Manufacturing contracted for the 11th straight month while Services remained in expansion territory.

- Europe: The Bank of England held rates steady and will reduce QT. The country's Unemployment rate hit 4.7% with wage growth stagnant and job vacancies declining. Wage pressures eased in the Eurozone as well and Swiss business confidence readings were subdued due to concerns about global trade.

- Asia: August Chinese CPI numbers remained in a downtrend although government subsidies for consumer goods boosted non-food inflation. Japanese CPI hit 2.7% in August, still well above the BoJ's 2% target but the BoJ left rates unchanged at 0.5%.

Index Returns Summary

| Asset Class | MTD | YTD |

|---|---|---|

| MSCI World | +1.85% | +15.98% |

| MSCI Asia Pacific | +2.04% | +20.96% |

| MSCI Europe | +1.09% | +26.79% |

| MSCI China | +6.39% | +35.61% |

| Bloomberg Barclays Global Aggregate Index | +0.77% | +7.98% |

| Bloomberg Commodities Index | +0.97% | +5.05% |

| HFRX Global | +1.09% | +5.22% |

| HFRX Macro/CTA | +2.81% | +1.93% |

| HFRX Equity Hedge | +1.08% | +7.79% |

Index data as of Sep. 12, 2025

Market Spotlight: Debt Fueled Expansion

As recessionary pressures reared their head in recent years, the government fiscal spigot has been a reliable stabilizer. Given the variable economic conditions across the United States, there is no political will to cutback on government spending. The bull case is that a surge in growth will help with government tax receipts, thereby decreasing budget deficit pressures. However a growing concern is, given how strong Q3 GDP is looking for the US, the case for lowering interest rates at this juncture is called into question. How far a rate reduction cycle goes to further stimulate inflationary pressures is an open question as government spending and low rates are never sustainable solutions to promote healthy organic growth in an economy.

Market Spotlight: Unstoppable Tech

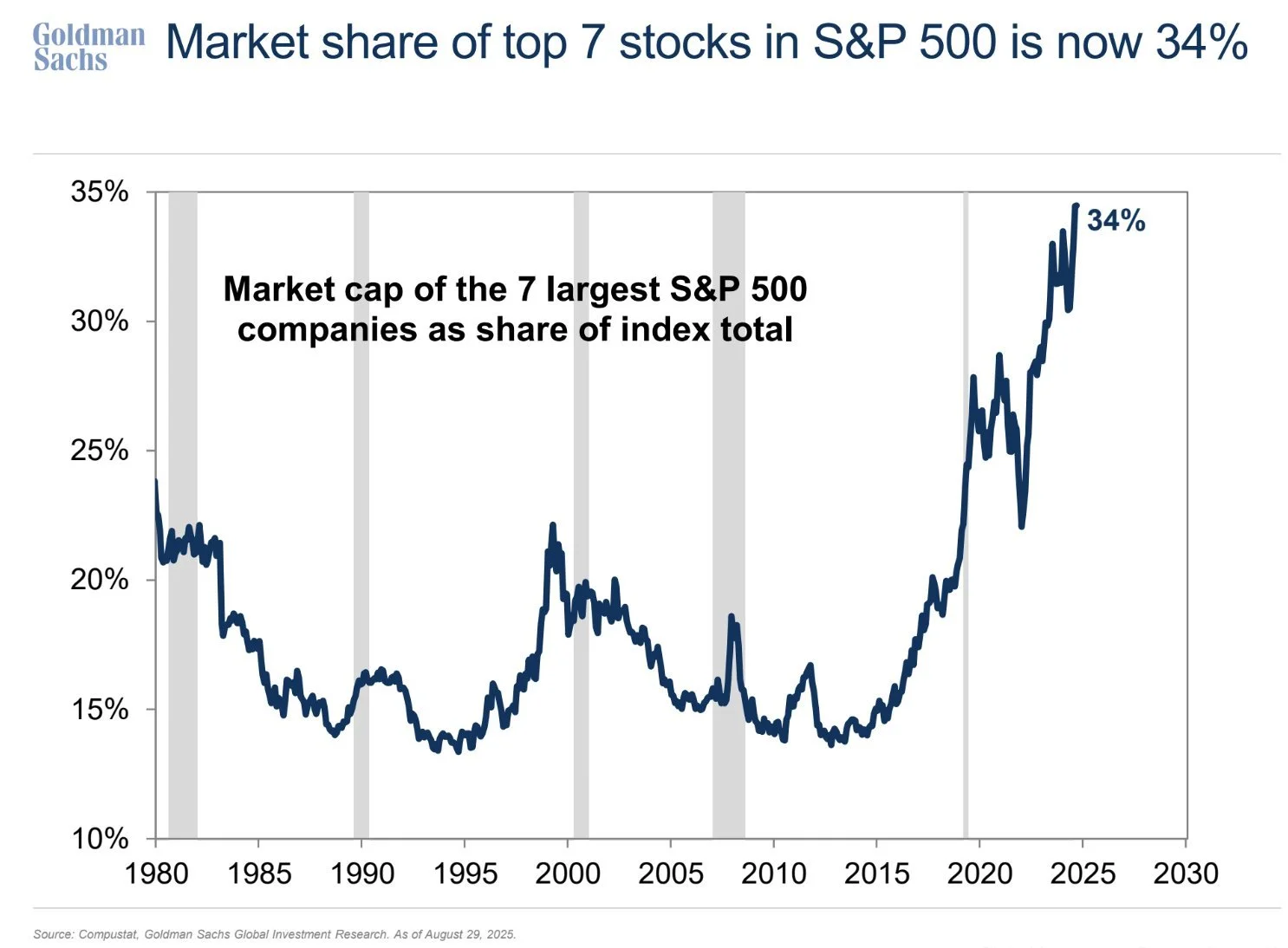

The continuous drumbeat of positive developments in the Al space continues at a torrent pace. From Oracle's explosive long-term earnings forecast to NVDA taking a $5b stake in Intel, the Al theme remains the best game in town. In response, Hedge funds are re-upping their Al exposure after the theme hit a soft-patch earlier this year. How far Al goes to propel equity markets to the next level remains unclear given the big gains for Al stocks that have been registered. This narrow leadership exemplifies the challenges for active equity strategies benchmarked to an increasingly more concentrated index comprised of companies all benefitting from the same business tailwinds.

Have Questions or Want to Learn More?

Our team is ready to provide further insights into our strategies and the current market landscape. Reach out to us today.

Contact UsDisclaimer: This material has been prepared by MASTERPIECE ADVISORS for informational purposes only and should not be construed as financial advice. Investments in hedge funds are speculative and involve a high of risk. This material is confidential and may not be disclosed without the express written approval of MASTERPIECE ADVISORS.