Market Note

Revisionist statisticians

Shockingly aggressive revisions in US jobs data paint a less rosy picture of US economic health over the past 24 months. These revisions not only suggest expectations for lower interest rates but also indicate a troubling shift for labor statistics departments, which now face job insecurity and the possibility of being replaced by officials aligned with the current administration's goals. While it's debatable whether the current analysts were intending to manipulate data, a trend toward reduced objectivity has serious implications for market pricing and economic transparency in the years to come.

Macro managers are currently operating at below-average risk levels, and the diminished independence of various previously objective US government entities is contributing to this cautious approach.

Global Markets & Economic Data

- Markets Summary: Vol remains subdued and global equities are well bid with multiple indices hitting all-time highs. The dollar remains rangebound within a downtrend, and rates are rallying across the curve.

- US: Three rate cuts before year-end is starting to become a possibility as weak jobs data combined with tepid inflation readings support reduced rates.

- Europe: Eurozone August Manufacturing and Services PMIs were both slightly in expansionary territory with Spain leading and France lagging. However, CY 2025 growth forecasts were trimmed to 0.9% from 1.3%. July's inflation rate held at 2.4%, and the July unemployment rate was 5.9%. UK GDP and inflation data remained soft. Swiss export activity picked up over the summer.

- Asia: Japan Q2 GDP data was higher than expected and there was cautious business optimism amid continued cost pressures. Chinese inflation data remained around flat. Chinese imports and exports were down y/y in August.

Index Returns Summary

| Asset Class | MTD | YTD |

|---|---|---|

| MSCI World | +0.36% | +14.49% |

| MSCI Asia Pacific | +0.38% | +19.30% |

| MSCI Europe | +0.20% | +25.90% |

| MSCI China | +1.93% | +31.15% |

| Bloomberg Barclays Global Aggregate Index | +0.58% | +7.79% |

| Bloomberg Commodities Index | -0.35% | +3.73% |

| HFRX Global | +0.65% | +4.78% |

| HFRX Macro/CTA | +1.59% | +0.71% |

| HFRX Equity Hedge | +0.82% | +7.53% |

Index data as of Sep. 5, 2025

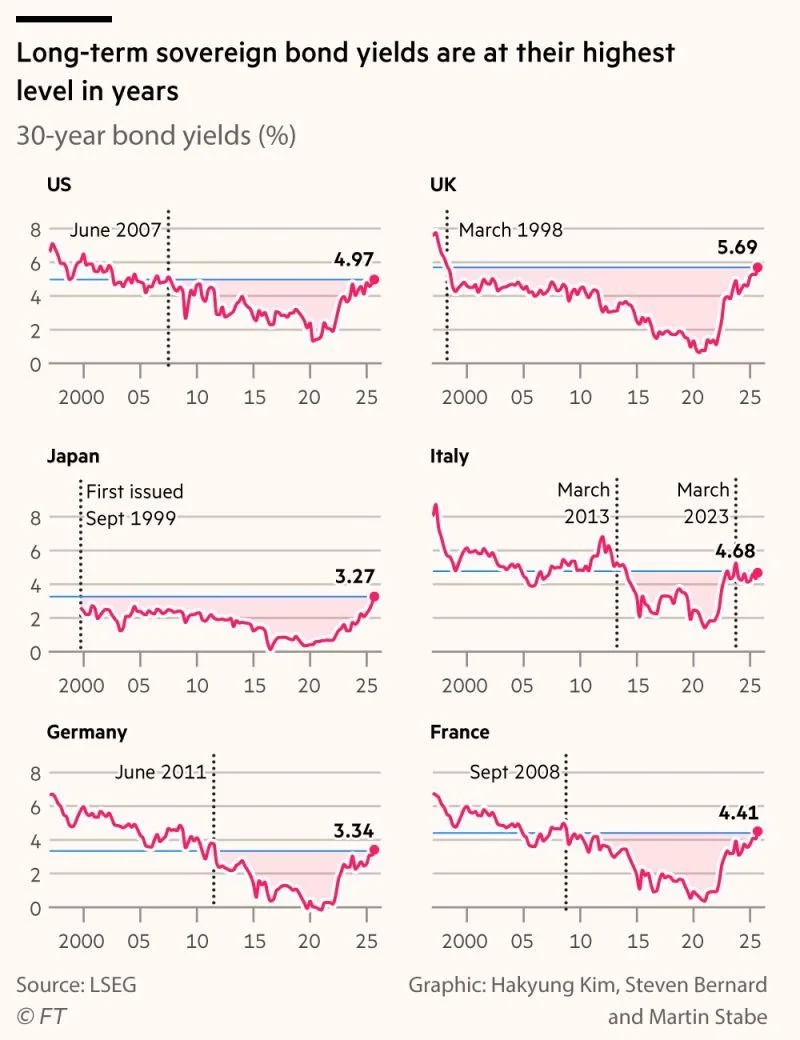

Market Spotlight: Global government debt yields

Ongoing inflation pressures, combined with potentially unsustainable debt levels and a growing willingness among politicians to promote economic growth through loose monetary and fiscal policies, strongly suggest the need for higher long-term rates.

Some macro investors are wary of how much further the US can reduce interest rates over the next year, given the underlying inflationary risks. Unfortunately, this inflation is occurring alongside declining growth prospects, leading to a disinflationary environment that bolsters the stability of alternative currencies like precious metals and cryptocurrencies.

As these trends become more pronounced, there may be a medium- to long-term public debt crisis that could necessitate drastic measures, including the restructuring of global debt liabilities at the national level.

Market Spotlight: Make America Grow Again!

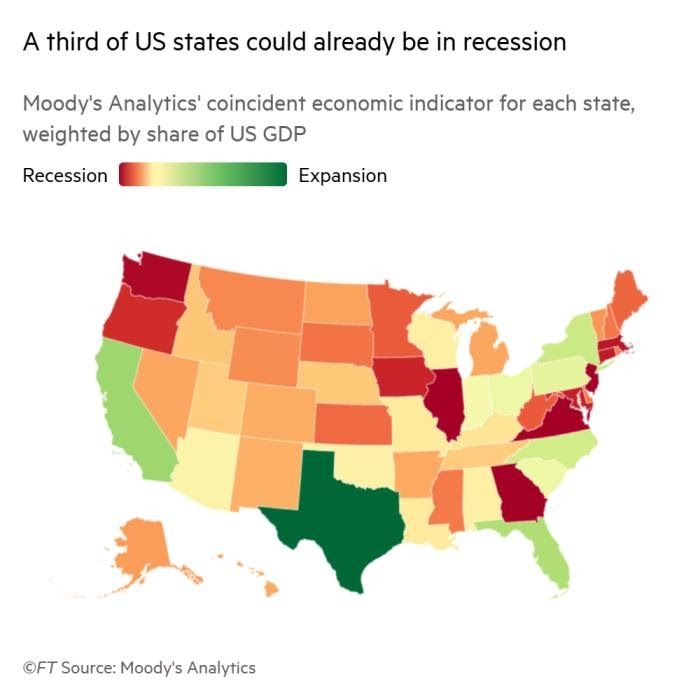

The complex US economy seems to be on varying economic paths. Manufacturing and service sectors are facing pressure, while regions benefiting from tech expansions and Al, such as Texas and California, remain strong. Recent labor market data indicates a building economic slowdown.

Will reducing interest rates be sufficient to counteract the negative forces affecting economic growth? Some investors believe rates may need to decrease by hundreds of basis points to effectively stimulate struggling areas like the housing market. Given ongoing inflationary pressures, a significant drop in US interest rates is unlikely. Furthermore, as interest rates decrease, there could be negative effects on the wealth effect; higher-income households that rely on the risk-free rate to support elevated consumption will not benefit as much, potentially intensifying growth challenges.

Have Questions or Want to Learn More?

Our team is ready to provide further insights into our strategies and the current market landscape. Reach out to us today.

Contact UsDisclaimer: This material has been prepared by MASTERPIECE ADVISORS for informational purposes only and should not be construed as financial advice. Investments in hedge funds are speculative and involve a high of risk. This material is confidential and may not be disclosed without the express written approval of MASTERPIECE ADVISORS.