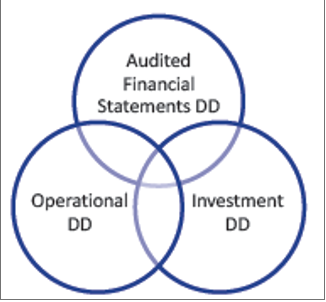

One critical due diligence component that should be emphasized further is the detailed analysis of hedge funds' annual audited financial statements. This best practices guide explores why incorporating in-depth annual audited financial statement (AFS) analysis should be a key component of a hedge fund investor's due diligence process.

An abundance of critical due diligence data points are found inside a fund's annual AFS. The AFS enables an analyst to verify an investment strategy (Schedule of Investments), review fund expenses (Statement of Operations) that are used for calculating the fund's Total Expense Ratio ("TER"), and provide insights into annual capital flows (Statement of Cash Flows) and related events (Notes to Financial Statements).

The investment schedule and ASC 820 classifications can be compared with ongoing manager disclosures to enable an investor to identify any investment strategy discrepancies.

The Allocator's Perspective

From the perspective of an allocator, taking the information gleaned in the audited financial statements one step further to reconcile with our ongoing investment and operational DD data points and checking back with the manager is a workflow that enables each contributor to the AFS analysis to complement one another in an overall verification of the data, further cementing our understanding about a hedge fund manager and their business model.