Market Note

Who Is the Smart Money Now?

Global Markets & Economic Data

- US: Weekly jobless claims fell for a sixth straight week, though June Durable Goods orders declined and Existing Home Sales are near a 15-year low.

- Europe: The ECB held its main deposit rate at 2.15%, as Manufacturing PMIs remain in contraction while Services PMIs show slight expansion.

- Asia: Tokyo's inflation is slowing but remains above the BOJ's target. China's Caixin Manufacturing PMI rose, but business confidence remains subdued.

- Market Theme: Mid-summer sees noisy price action with low visibility at the macro level, though trade deals and corporate earnings are bolstering sentiment.

Index Returns Summary (YTD)

Equity

+10.77%

Fixed Income

-1.15%

Commodities

+6.34%

The VanEck Social Sentiment ETF has significantly outperformed the S&P 500 since the April 8 low. Non-professional individual investors have often been perceived as less sophisticated than career financial professionals. However, there are periods, such as January 2021 and more recently, when these investors make capital allocation decisions based on sentiment and soft factors, leading to extreme price movements in individual equities.

"During these moments, hedge funds must aggressively risk manage positions that fall into the crosshairs of these sentiment driven investor flows."

Market Spotlight: Quant Equity Funds Are Struggling

Market volatility is at YTD lows and rampant liquidity is causing quant equity strategies to give back a portion of their YTD returns. As quant portfolios adjust their risk-taking levels, their trading flows are exacerbating already stretched price movements against consensus fundamental equity exposures.

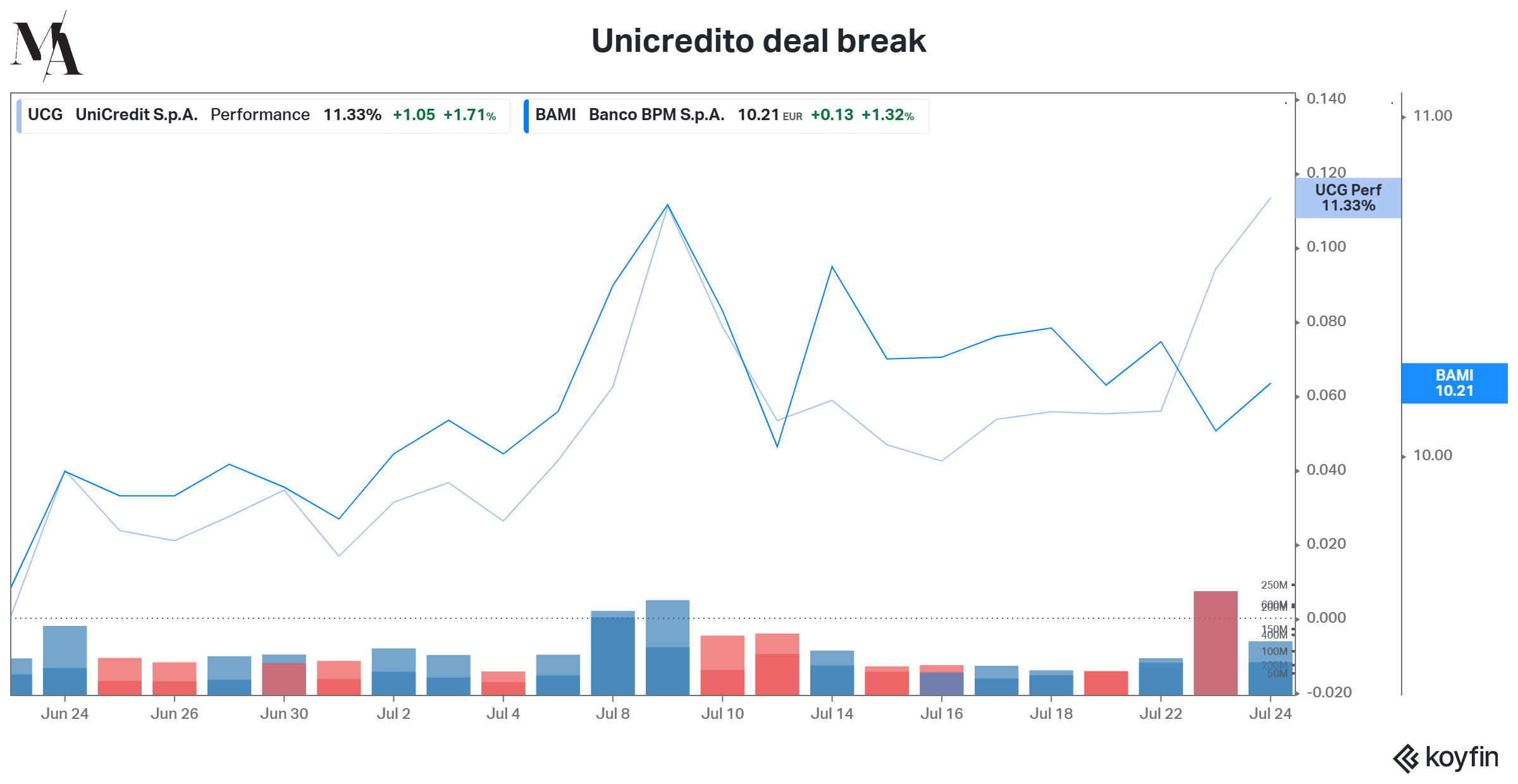

Market Spotlight: EU M&A Deal Break Alert

UniCredit withdrew its proposed acquisition of Banco BPM in July 2025, citing failure to secure the required government "golden power" authorization. The ensuing price action caused losses for Event hedge funds positioned in the all-stock deal as UniCredit rallied and BPM's shares sold off.

Have Questions or Want to Learn More?

Our team is ready to provide further insights into our strategies and the current market landscape. Reach out to us today.

Contact UsDisclaimer: This material has been prepared by MASTERPIECE ADVISORS for informational purposes only and should not be construed as financial advice. Investments in hedge funds are speculative and involve a high of risk. This material is confidential and may not be disclosed without the express written approval of MASTERPIECE ADVISORS.