Market Note

The maven of Nihonbashi

January 30th, 2026

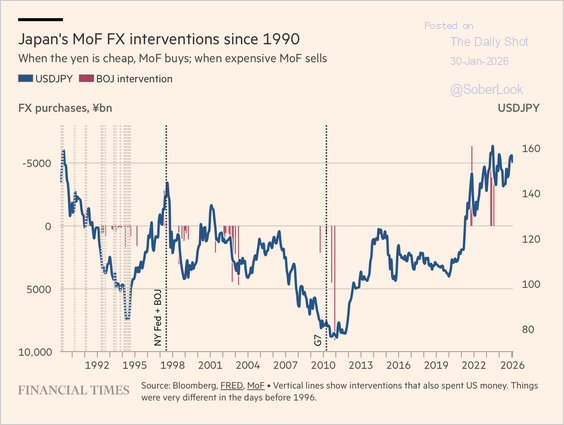

When the yen is cheap, MoF buys; when expensive MoF sells

Chart Source(s): Bloomberg, The Daily Shot

Corporate earnings, US presidential decrees, central banks and speculative flows are causing market prices to trend, extend and reverse into month-end.

The Bank of Japan (BOJ) head office is located in the Nihonbashi district of Chuoku, Tokyo, Japan. The central bank is legendary in the markets and has an enshrined track record of buying the yen when its cheap and selling when it gets too expensive for the Japanese export industry.

The buy low and sell high discipline of the bank has generated an estimated $300b of trading profits since 1990. Given the USD/JPY has been testing a psychological/technical level of 1.60 in recent weeks, there is speculation the bank will intervene again.

Global Markets & Economic Data

- US: The Fed held interest rates at 3.75% and communicated a modestly hawkish tone. Nov. Durable Goods Orders jumped higher, rising 5.3% m/m. President Trump named Kevin Warsh as the next Fed Chairman.

- Switzerland/UK/Eurozone: Swiss economic sentiment readings in January surprisingly fell after rising at the end of 2025. UK Retail Sales and PMI readings were higher than expected. The Jan. Eurozone composite PMI was in expansion territory for the 13th consecutive month. Business and consumer sentiment readings picked up.

- Japan/China: Japanese core CPI edged lower to 2% versus 2.3% previously. Chinese FDI fell 7.5% y/y in Dec.

Index Returns Summary

| Asset Class | MTD | YTD |

|---|---|---|

| MSCI World | 1.69% | 1.69% |

| MSCI Asia Pacific | 5.15% | 5.15% |

| MSCI Europe | 2.74% | 2.74% |

| MSCI China | 3.88% | 3.88% |

| Bloomberg Barclays Global Aggregate Index | 0.14% | 0.14% |

| Bloomberg Commodities Index | 9.10% | 9.10% |

| HFRX Global | 1.74% | 1.74% |

| HFRX Macro/CTA | 3.23% | 3.23% |

| HFRX Equity Hedge | 1.68% | 1.68% |

Index data as of January 23, 2026

Market Spotlight: Buy China

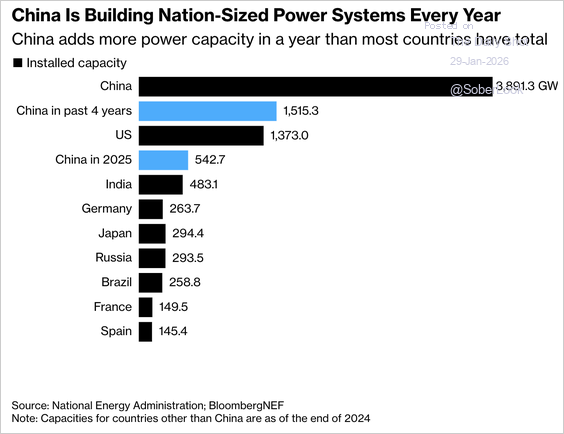

As much of the US freezes in a never ending winter paralysis, moments of fear about the country's shaky ageing power grid take hold.

Chart Source(s): National Energy Administration, BloombergNEF, tradingeconomics.com, Ministry of Commerce of the People's Republic of China

Market Spotlight: Risk On

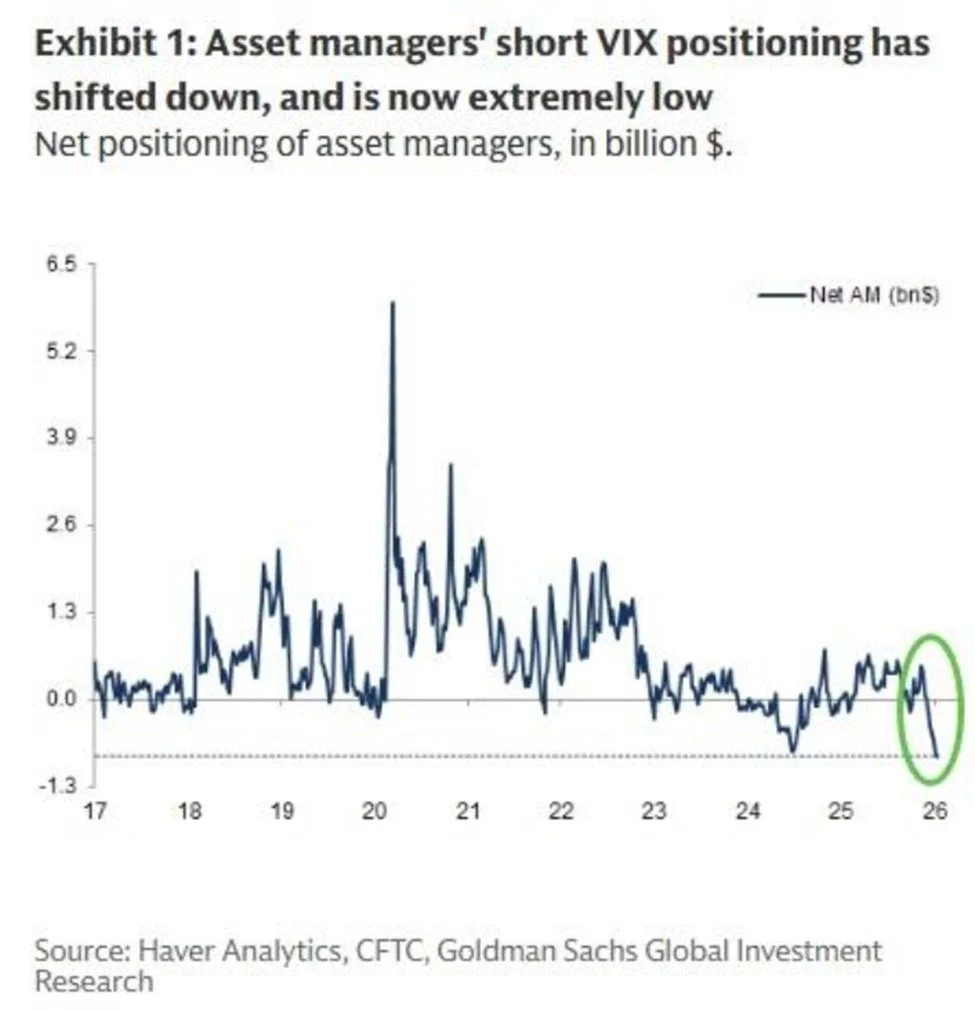

Positioning is increasingly one-way in the markets. Retail investors, hedge funds and institutions are all long.

Chart Source(s): Haver Analytics, CFTC, Goldman Sachs Global Investment Research, The Daily Shot, Citadel Securities

Have Questions or Want to Learn More?

Our team is ready to provide further insights into our strategies and the current market landscape. Reach out to us today.

Contact UsDisclaimer: This material has been prepared by MASTERPIECE ADVISORS for informational purposes only and should not be construed as financial advice. Investments in hedge funds are speculative and involve a high degree of risk. This material is confidential and may not be disclosed without the express written approval of MASTERPIECE ADVISORS.