Market Note

Dumb money

January 23rd, 2026

Market moves have gone against hedge-fund positioning this year

Chart Source(s): Bloomberg

The Russell 2000 has outperformed the S&P 500 and Nasdaq practically every trading day of 2026. The outperformance is fueled by rampant US retail flows and fundamentally driven cyclical rotations as the market "broadens".

Many hedge funds are opportunistic and can sidestep this violent turn of events at a factor/sector/market cap/style level. However, last year's winners are no longer at the top of the charts and that is taking a toll on quant strategies in particular.

The big bid in heavily shorted stocks is adding insult to injury for manager's short books. Over time these technical aberrations normalize creating profitable opportunities going forward, but in the interim there is some blood out on the streets.

Global Markets & Economic Data

- US: The odds of a Kevin Warsh appointment increased this week leading to the pricing in of fewer rate cuts because Warsh is viewed as less dovish than previous leading candidate Hassett. Q4 core PCE figures were in-line with estimates, suggesting easing inflationary pressures. Mortgage applications trended higher, but December pending home sales surprisingly crashed. NY Fed Services Activity showed a slight uptick in January but remains in contractionary territory with employment falling for a fifth consecutive month.

- EU/UK: Euro ZEW sentiment data rose more than expected in January and prelim Q4 GDP estimates are ticking up. UK unemployment held steady at 5.1% and inflation was up 3.4% y/y.

- China/Japan: Q4 Chinese GDP fell to 4.5%, but CY 2025 hit the 5% target, driven by exports. The housing market remains weak with new home prices falling 2.7% y/y and house prices have fallen for 30 consecutive months. Japan's prime minister called a snap election for February 8th, which sent JGB prices falling. 10-year yields hit their highest level since 1999. Later in the week, the BoJ signaled more hikes ahead. M/M Japan Machinery Orders fell the most since 2020. Trade surplus data was well below expectations.

Index Returns Summary

| Asset Class | MTD | YTD |

|---|---|---|

| MSCI World | 1.96% | 1.96% |

| MSCI Asia Pacific | 5.35% | 5.35% |

| MSCI Europe | 2.45% | 2.45% |

| MSCI China | 4.48% | 4.48% |

| Bloomberg Barclays Global Aggregate Index | -0.33% | -0.33% |

| Bloomberg Commodities Index | 3.63% | 3.63% |

| HFRX Global | 1.42% | 1.42% |

| HFRX Macro/CTA | 2.25% | 2.25% |

| HFRX Equity Hedge | 1.59% | 1.59% |

Index data as of January 16, 2026

Market Spotlight: The ROW vs US trade is back

Investors spent the start of last year focused on the end of US exceptionalism. However, by YE the ROW vs US trade lost much of its momentum.

Chart Source(s): BofA Global Investment Strategy, EPFR, Koyfin

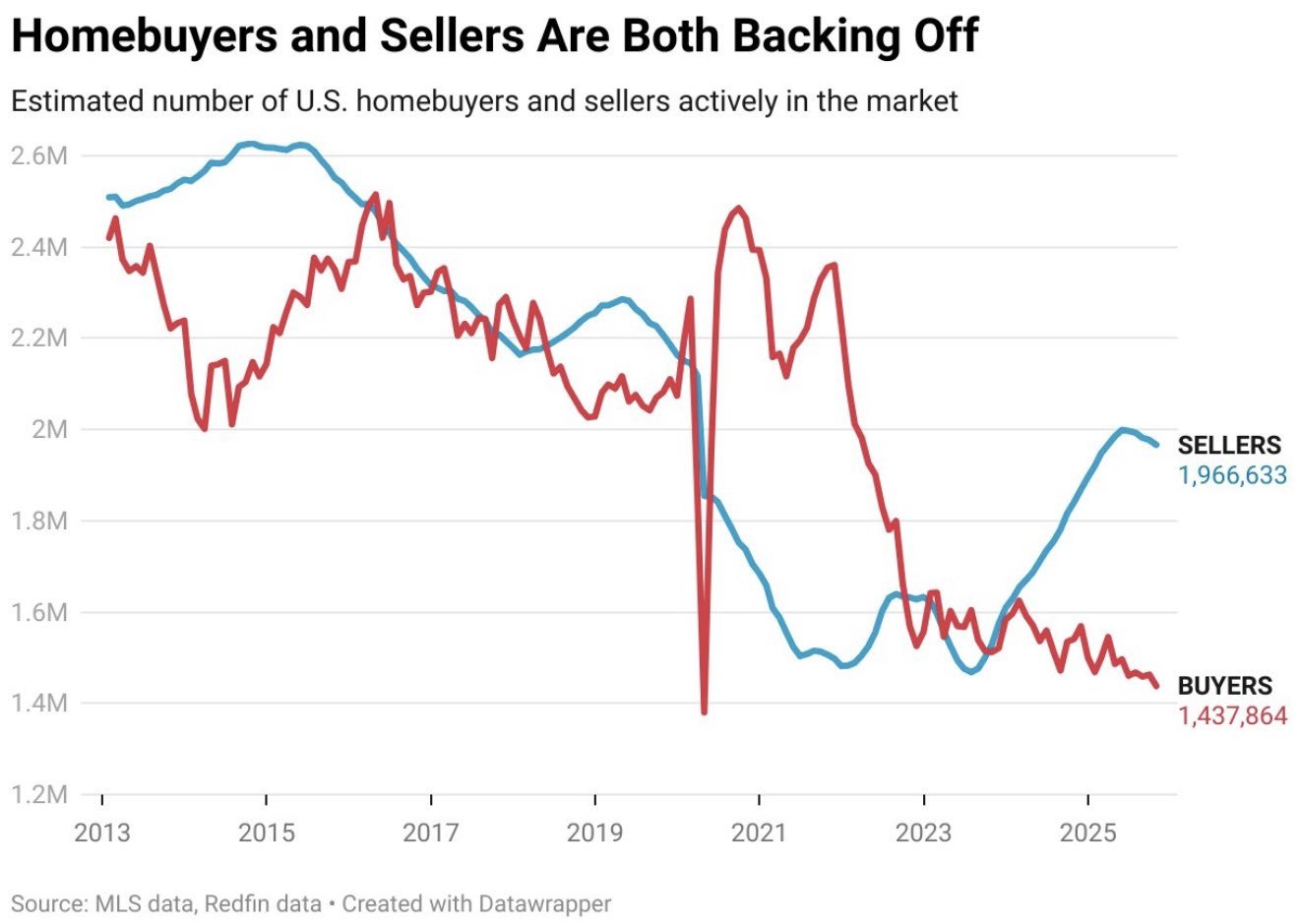

Market Spotlight: Don't pop the cork yet for US housing

Professional investors involved in the housing sector admit that 2026 earnings forecasts for homebuilders are looking terrible.

Chart Source(s): MLS data, Redfin data, Datawrapper, Koyfin

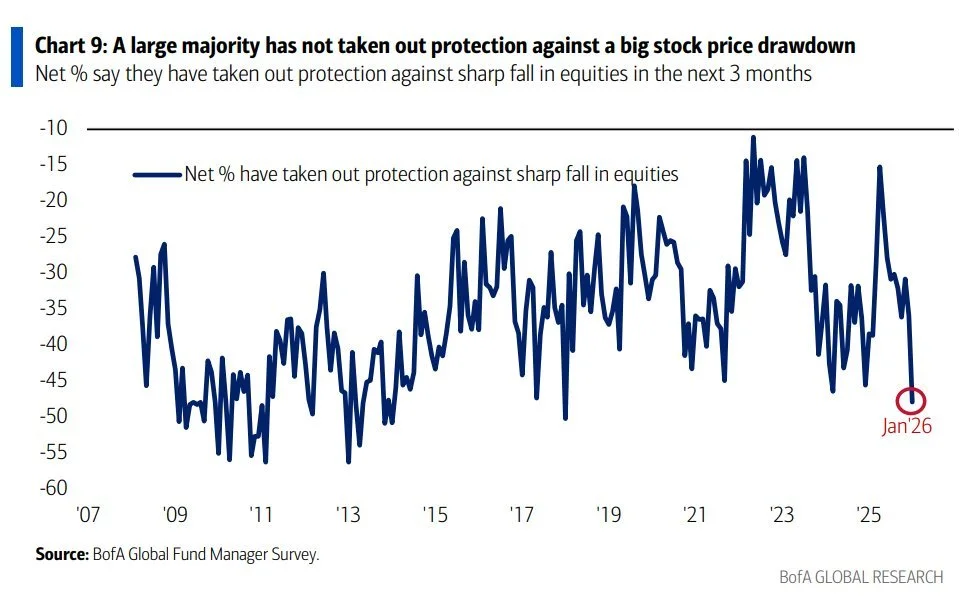

Market Spotlight: Toxic Optimism

The old hackneyed phrase, "when the tide goes out you can see who is swimming with no trunks," comes to mind when reviewing the findings of the latest BoFA Global Fund Manager Survey.

Chart Source(s): BofA Global Fund Manager Survey, BofA GLOBAL RESEARCH

Have Questions or Want to Learn More?

Our team is ready to provide further insights into our strategies and the current market landscape. Reach out to us today.

Contact UsDisclaimer: This material has been prepared by MASTERPIECE ADVISORS for informational purposes only and should not be construed as financial advice. Investments in hedge funds are speculative and involve a high degree of risk. This material is confidential and may not be disclosed without the express written approval of MASTERPIECE ADVISORS.