Market Note

Long Greenland!

January 9th, 2026

Chart Source(s): The Daily Shot

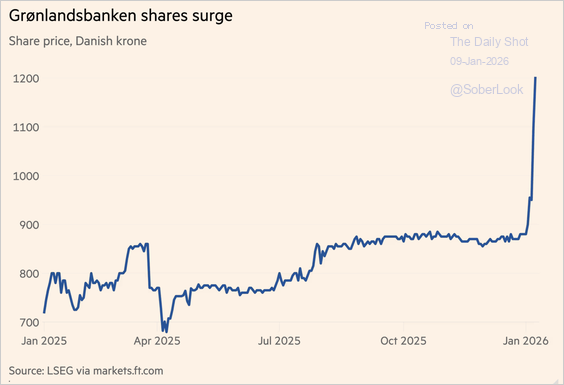

The start of the year has featured a marked increase in initiatives by the US government on various economic and geopolitical fronts. This chart is included as a very unserious example of how headline driven price action is dominating the market landscape in the first days of the new year.

With "stimmy checks" on the way, the speculative fervor is rampant for those seeking to generate short-term gains from pushing various topical thematic exposures higher. Various areas like speculative aerospace, rare earths, obscure small cap housing/financials companies and small cap commodities are getting bid to the moon.

Thematic squeezes and headline driven price action ultimately creates great opportunities for longer term fundamentally-driven positioning, but in the meantime it does not feel good to be on the other side when stocks are getting memed.

Global Markets & Economic Data

- US: 50k jobs were added in Dec., slightly below consensus and the unemployment rate fell to 4.4%.

- Switzerland/UK/Eurozone: The Swiss unemployment rate held in at 3%. Q4 UK consumer inflation data ticked lower. Eurozone manufacturing PMIs remain in contractionary territory.

- China/Japan: Chinese CPI was up 0.8% y/y. Japanese consumer spending surprised to the upside.

Index Returns Summary

| Asset Class | MTD | YTD |

|---|---|---|

| MSCI World | 0.84% | 21.43% |

| MSCI Asia Pacific | 1.11% | 23.40% |

| MSCI Europe | 3.91% | 35.02% |

| MSCI China | -1.21% | 31.82% |

| Bloomberg Barclays Global Aggregate Index | 0.26% | 8.15% |

| Bloomberg Commodities Index | -0.65% | 11.14% |

| HFRX Global | 0.58% | 7.10% |

| HFRX Macro/CTA | 1.30% | 5.53% |

| HFRX Equity Hedge | 0.92% | 9.97% |

Index data as of December 31st, 2025

Market Spotlight: HF alpha and positioning

Chart Source(s): Goldman Sachs

Long alpha was persistent throughout the year while short alpha made a nice comeback in the final months of the year after being quite challenged around Q3. Many of the highly speculative AI themes like quantum computing generally burnt themselves out by Q4. Heading into the start of 2026, manager short books are teaming with compelling overvalued situations in fundamentally weak companies.

Market Spotlight: What market environment are we in?

Chart Source(s): Daily Shot

Is it gloom and doom or goldilocks forever? The shifting jobs landscape, accelerated by AI disruptions remains a major concern among macro data watchers. However, jobs data has yet to fully rollover. On the flipside, US Q4 GDP data is tracking to be a blockbuster quarter.

Have Questions or Want to Learn More?

Our team is ready to provide further insights into our strategies and the current market landscape. Reach out to us today.

Contact UsDisclaimer: This material has been prepared by MASTERPIECE ADVISORS for informational purposes only and should not be construed as financial advice. Investments in hedge funds are speculative and involve a high of risk. This material is confidential and may not be disclosed without the express written approval of MASTERPIECE ADVISORS.