Market Note

There is a common market driver

December 19th, 2025

Chart Source(s): BlackRock

Risk assets seem to be on the naughty list this December as the Nasdaq recently clocked its worst five day stretch since April. Sentiment has improved into the weekend but be on guard for nonsensical price movements until the calendar year rolls over.

Global Markets & Economic Data

- US: Stale jobs continued to paint a mixed picture of the US economy while CPI data hit a 4-year low. Existing Home sales data unexpectedly rose while the Michigan Sentiment index moved lower with 1-year inflation expectations rising.

- Switzerland/Eurozone/UK: Switzerland's trade surplus widened in November, supported by the revised US tariff deal bringing levies down to 15% from 39%. The ECB held rates at 2% and the Eurozone current account surplus is widening. Lagarde described the current policy rate as being in a "good place" and GDP forecasts were upgraded. The BoE cut rates by 0.25% to 3.75% as expected, its 4th cut in 2025.

- Japan/China: The BoJ raised rates from 0.5% to 0.75%, which is a 30-year high sending 10-year yields above 2%. Japanese November CPI data remained hot at 3% but is trending lower. Chinese FDI is still negative at -10% y/y.

Index Returns Summary

| Asset Class | MTD | YTD |

|---|---|---|

| MSCI World | +0.27% | +20.86% |

| MSCI Asia Pacific | +1.76% | +24.05% |

| MSCI Europe | +1.48% | +32.59% |

| MSCI China | +0.58% | +33.61% |

| Bloomberg Barclays Global Aggregate Index | -0.21% | +7.67% |

| Bloomberg Commodities Index | -1.30% | +10.50% |

| HFRX Global | +0.23% | +6.75% |

| HFRX Macro/CTA | +0.13% | +4.36% |

| HFRX Equity Hedge | +0.41% | +9.46% |

Index data as of December 12th, 2025

Market Spotlight: EM en vogue

A winning contrarian exposure in hedge fund portfolios YTD has been stock and bond investments in emerging markets.

Chart Source(s): Bloomberg

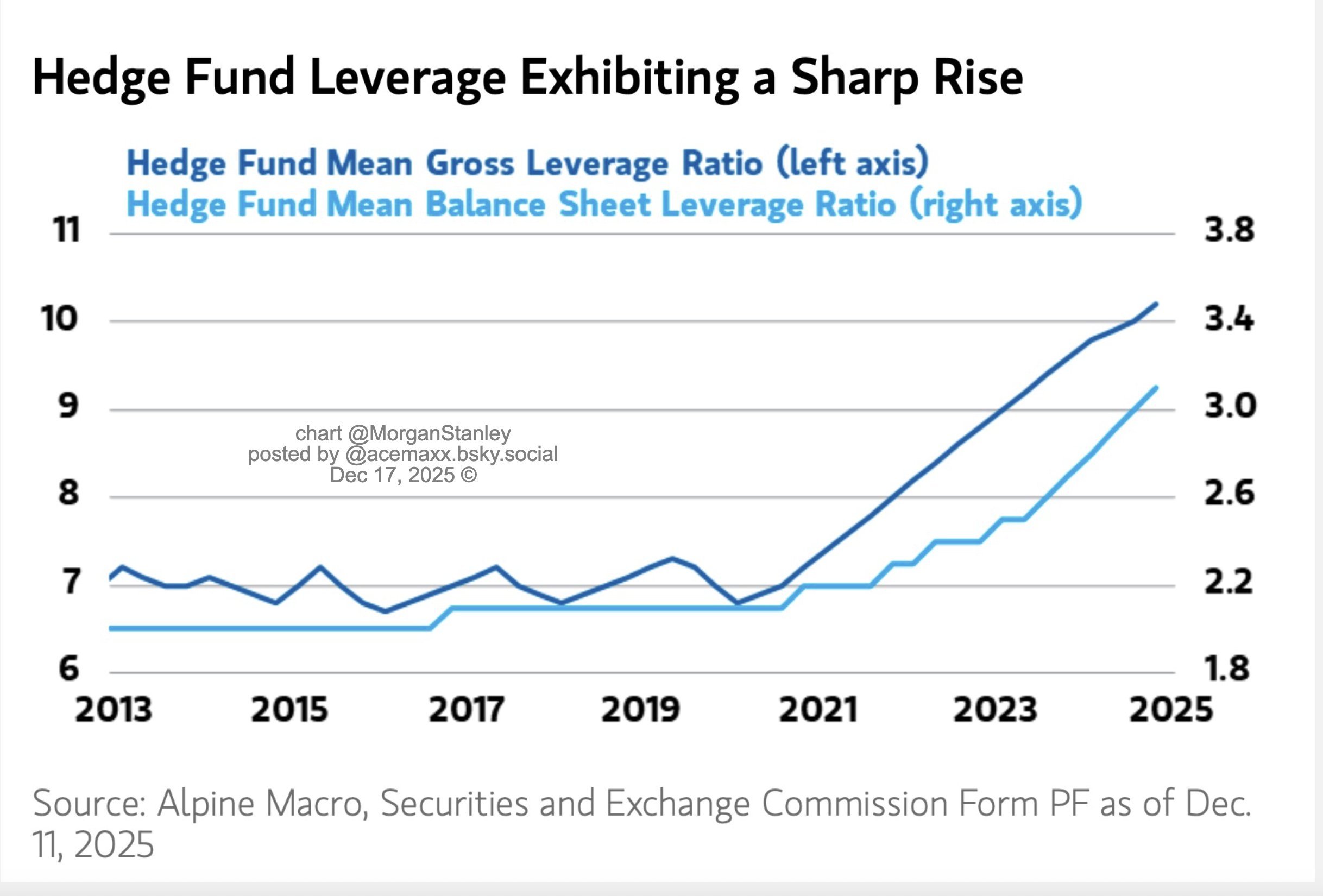

Market Spotlight: Leverage, is it a problem?

Systematic market shocks typically occur when new information spurs on the need for portfolio rebalancing and de-risking. Developments typically create a waive of portfolio changes that disrupt established market patterns and relationships leading to a further need for investor portfolio changes. The severity of a shock is usually driven by a combination of the implications of the new information and the magnitude of de-risking/portfolio changes that take place.

Chart Source(s): Alpine Macro, Securities and Exchange Commission, VettaFi

Have Questions or Want to Learn More?

Our team is ready to provide further insights into our strategies and the current market landscape. Reach out to us today.

Contact UsDisclaimer: This material has been prepared by MASTERPIECE ADVISORS for informational purposes only and should not be construed as financial advice. Investments in hedge funds are speculative and involve a high degree of risk. This material is confidential and may not be disclosed without the express written approval of MASTERPIECE ADVISORS.